Securing affordable home insurance in California can feel like navigating a maze. The Golden State’s unique geography, diverse housing stock, and susceptibility to natural disasters significantly impact premiums. This guide unravels the complexities of the California home insurance market, providing practical strategies to find the cheapest options without sacrificing essential coverage. We’ll explore factors influencing costs, compare different policies, and highlight resources to help you secure the best possible protection for your home.

From understanding the impact of your location and home features to leveraging discounts and navigating the claims process, we’ll equip you with the knowledge to make informed decisions. We’ll also delve into available government programs and assistance, ensuring you’re aware of all potential avenues for saving money on your home insurance premiums.

Understanding California’s Home Insurance Market

California’s home insurance market is complex and dynamic, influenced by a multitude of factors that significantly impact premiums. Understanding these factors is crucial for homeowners seeking the best and most affordable coverage.

Factors Influencing Home Insurance Costs in California

Several key factors contribute to the variability of home insurance costs across California. These include location, the age and construction of the home, its proximity to wildfire-prone areas, the presence of earthquake faults, and the homeowner’s claims history. Coastal properties, for example, often face higher premiums due to increased risk of damage from storms and flooding. Homes built with fire-resistant materials may command lower premiums in high-risk fire zones compared to those constructed with more flammable materials. A homeowner’s claims history also significantly impacts their insurance rate; a history of frequent claims can lead to substantially higher premiums.

Types of Home Insurance Policies Available in California

California homeowners have access to several types of home insurance policies, each offering varying levels of coverage. The most common is the HO-3 policy, which provides comprehensive coverage for damage to the dwelling and personal property from various perils, excluding specifically excluded events. HO-4 policies, or renters insurance, protect tenants’ personal belongings. HO-6 policies are designed for condominium owners, covering their personal belongings and their interest in the unit itself. Specialized policies, such as those offering flood or earthquake coverage, are often purchased separately due to the high risk associated with these specific perils in certain areas of California.

Average Home Insurance Premiums Across California Regions

Average home insurance premiums vary considerably across California’s diverse regions. Coastal areas and regions with high wildfire risk generally experience significantly higher premiums than inland areas with lower risk profiles. For instance, a homeowner in Malibu might pay considerably more than a homeowner in Sacramento, reflecting the increased risk of wildfire and coastal damage in the former location. While precise figures fluctuate based on numerous factors, a general trend shows a clear correlation between risk and premium cost. Data from the California Department of Insurance or independent insurance comparison websites can provide more specific regional premium comparisons.

Comparison of Coverage Offered by Different Insurance Providers in California

The following table offers a simplified comparison of coverage offered by several major insurance providers in California. Note that actual coverage and premiums will vary based on individual circumstances and policy specifics. This table is for illustrative purposes only and does not constitute a complete or exhaustive comparison.

| Insurance Provider | Dwelling Coverage | Personal Property Coverage | Liability Coverage |

|---|---|---|---|

| Provider A | Up to $500,000 | Up to $250,000 | $300,000 |

| Provider B | Up to $750,000 | Up to $375,000 | $500,000 |

| Provider C | Up to $1,000,000 | Up to $500,000 | $1,000,000 |

| Provider D | Up to $250,000 | Up to $125,000 | $100,000 |

Factors Affecting Home Insurance Premiums

Several key factors influence the cost of home insurance in California. Understanding these elements allows homeowners to better assess their premiums and potentially take steps to lower their costs. These factors can be broadly categorized into location-specific risks, property characteristics, and individual risk profiles.

Location’s Impact on Home Insurance Costs

The geographic location of a property significantly impacts its insurance premium. Areas prone to wildfires, earthquakes, floods, or other natural disasters command higher premiums due to the increased risk of damage. For example, homes situated in wildfire-prone areas of Southern California will typically face substantially higher premiums than those located in less hazardous regions of Northern California. Coastal properties, vulnerable to storm surges and erosion, also generally attract higher premiums. Insurance companies use sophisticated risk models incorporating historical data on natural disaster frequency and severity in specific zip codes to assess and price risk. The proximity to fire hydrants and the quality of local fire protection services can also influence premium calculations.

Influence of Home Features on Premiums

The features of a home itself play a crucial role in determining insurance costs. The age of the home is a significant factor; older homes, especially those lacking modern safety features, often carry higher premiums due to increased vulnerability to damage. The construction materials also matter; homes built with fire-resistant materials like brick or concrete may receive lower premiums compared to those built with wood framing. The presence of security systems, such as alarms and fire sprinklers, can significantly reduce premiums as they mitigate the risk of loss. Furthermore, the home’s overall condition, including the quality of its roof, plumbing, and electrical systems, is evaluated. Regular maintenance and upgrades can positively impact insurance costs.

Individual Risk Factors and Premium Determination

Individual risk factors also play a substantial role in calculating premiums. A homeowner’s credit score is often a significant factor, with those possessing higher credit scores generally qualifying for lower premiums. This is because a strong credit history suggests a greater likelihood of responsible financial behavior, reducing the insurer’s perceived risk. Past claims history is another crucial factor; homeowners with a history of filing claims may face higher premiums, reflecting the increased risk of future claims. The type of coverage chosen also affects the premium; comprehensive coverage naturally costs more than a basic policy.

Flowchart Illustrating Home Insurance Premium Calculation

The process of calculating a home insurance premium is complex, but can be visualized as a flowchart.

[Imagine a flowchart here. The flowchart would begin with a box labeled “Input Data,” containing branches for: Location Data (zip code, proximity to hazards), Property Data (age, construction, security systems, square footage), and Individual Data (credit score, claims history). These branches would converge into a central processing box labeled “Risk Assessment Algorithm,” which would then lead to a final box labeled “Premium Calculation,” resulting in the final premium amount. Arrows would connect the boxes to show the flow of information.]

Government Programs and Assistance

Finding affordable home insurance in California can be challenging, but several government programs and initiatives aim to alleviate the burden for eligible residents. These programs often provide financial assistance or access to resources that can help lower premiums or make insurance more accessible. Understanding the specifics of these programs is crucial for homeowners seeking relief.

Finding and applying for these programs may require some research and effort. Eligibility criteria vary, and the application processes can differ. However, the potential savings can be significant, making the effort worthwhile for those who qualify. It’s essential to check eligibility requirements regularly, as program guidelines and funding can change.

California Earthquake Authority (CEA)

The CEA is a publicly funded, not-for-profit organization that provides earthquake insurance to California homeowners. It’s not a direct subsidy program, but it offers affordable earthquake coverage that would otherwise be difficult or expensive to obtain through private insurers. CEA policies are available to homeowners who meet specific criteria, such as residing in a high-earthquake risk zone and having property insurance. Their website provides detailed information on eligibility, policy options, and application procedures. The CEA significantly reduces the financial risk associated with earthquakes for California residents, a considerable benefit given the state’s seismic activity.

Federal Emergency Management Agency (FEMA)

While not solely focused on home insurance, FEMA plays a crucial role in disaster relief, including providing assistance after natural disasters like wildfires and floods. FEMA’s aid might not directly cover home insurance premiums, but it can offer grants or low-interest loans for repairs and rebuilding after a covered disaster event. Eligibility depends on the specific disaster and the level of damage sustained. Homeowners should contact FEMA directly after a disaster to determine their eligibility for assistance. The FEMA website provides detailed information about their disaster assistance programs and application processes.

Local Assistance Programs

Many California counties and municipalities offer their own assistance programs for low-to-moderate-income homeowners struggling with housing costs, which may include insurance. These programs are often funded through local taxes or grants and have varying eligibility criteria based on income levels, household size, and property value. These programs are less standardized than state or federal programs and require researching the specific programs offered in your county or city. Contacting your local government office or searching online for “[your city/county] home insurance assistance” is the best way to find these resources.

Available Assistance Programs: A Summary

The following is a brief summary of some available assistance programs. Eligibility requirements and specific benefits vary; refer to the official program websites for the most current and detailed information.

- California Earthquake Authority (CEA): Provides earthquake insurance coverage.

- Federal Emergency Management Agency (FEMA): Offers disaster relief assistance, including grants and loans after qualifying events.

- Local County/City Assistance Programs: Various programs exist at the local level, often focused on low-to-moderate-income homeowners; eligibility and benefits vary widely by location.

Last Recap

Finding the cheapest home insurance in California requires careful research and a strategic approach. By understanding the factors that influence premiums, exploring various policy options, and utilizing available resources, you can significantly reduce your costs without compromising the protection of your most valuable asset. Remember to compare quotes from multiple insurers, consider bundled policies, and explore available discounts to secure the best deal. Proactive planning and informed decision-making are key to securing affordable and comprehensive home insurance coverage in California.

User Queries

What is the average cost of home insurance in California?

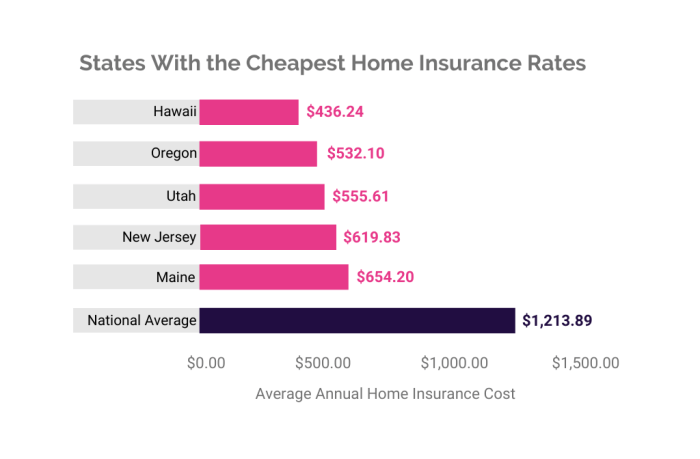

The average cost varies significantly based on location, home features, and coverage level. It’s impossible to give a single figure, but expect premiums to be higher than the national average due to the state’s risk profile.

How often can I change my home insurance provider?

You can typically switch providers at the end of your policy term. There’s usually no penalty for switching, though you may need to provide proof of insurance from your current provider.

What if I have a poor credit score? Will it affect my premiums?

Yes, insurers often consider credit scores when determining premiums. A lower credit score usually results in higher premiums, reflecting a perceived higher risk.

Can I bundle my home and auto insurance for a discount?

Yes, many insurers offer discounts for bundling home and auto insurance. This is a common way to save money on both premiums.