Navigating the world of insurance can feel overwhelming, but understanding the potential savings and benefits of bundling your home and auto insurance is a crucial step towards financial security. This guide delves into the intricacies of bundled insurance, exploring the advantages, comparison strategies, and online tools available to help you secure the best possible coverage at the most competitive price.

We’ll examine how bundling your home and auto insurance policies can lead to significant cost reductions, discuss the key factors to consider when comparing quotes from different providers, and offer practical tips for selecting a policy that perfectly aligns with your individual needs and budget. This comprehensive approach empowers you to make informed decisions and achieve optimal protection.

Competitive Landscape

The bundled home and auto insurance market is fiercely competitive, with numerous major players vying for market share. Understanding the competitive landscape is crucial for both insurers and consumers seeking the best value and coverage. This analysis compares prominent providers, highlighting key differentiators in their offerings, pricing, and customer perception.

Major Provider Offerings

A comparison of major insurance providers reveals significant variations in coverage options, pricing structures, and customer service. While many offer similar basic coverages, differences emerge in add-on options, discounts, and the overall customer experience. For instance, some insurers specialize in specific demographics (e.g., young drivers, homeowners with high-value properties), while others focus on broader market segments. This specialization often translates to tailored product offerings and marketing strategies.

Key Features and Benefits

Competitors leverage various features and benefits to attract and retain customers. These include discounts for bundling, safe driving programs, home security systems, and loyalty programs. Some insurers offer unique benefits like roadside assistance, identity theft protection, or pet insurance as add-ons to their bundled packages. The availability and cost of these add-ons vary significantly across providers. For example, one insurer might offer a comprehensive roadside assistance package as a standard feature, while another might charge extra for this service.

Effective Marketing Strategies

Effective marketing strategies are crucial for success in this competitive market. Many insurers utilize digital marketing channels such as targeted online advertising, social media campaigns, and search engine optimization () to reach potential customers. Others employ traditional methods like television commercials and print advertising, often supplemented by personalized email marketing and loyalty programs. For instance, a successful campaign might leverage data analytics to identify specific customer segments and tailor messaging to their needs and preferences.

Competitive Analysis Table

| Provider | Key Features | Pricing Model | Customer Ratings (Example – based on hypothetical data) |

|---|---|---|---|

| Insurer A | Bundled discounts, telematics program, 24/7 roadside assistance | Tiered pricing based on risk assessment | 4.5 stars |

| Insurer B | Competitive pricing, strong online platform, various add-on options | Usage-based insurance (UBI) option available | 4.2 stars |

| Insurer C | Focus on customer service, personalized support, strong claims handling | Traditional actuarial pricing | 4.7 stars |

| Insurer D | Extensive coverage options, strong financial stability, various discounts | Value-based pricing, potential for significant discounts | 4.0 stars |

Bundling Benefits and Savings

Bundling your home and auto insurance policies with a single insurer offers significant financial advantages, often resulting in substantial savings compared to purchasing separate policies. This strategic approach simplifies your insurance management while potentially lowering your overall premiums. The combined coverage provides comprehensive protection for your most valuable assets – your home and your vehicle.

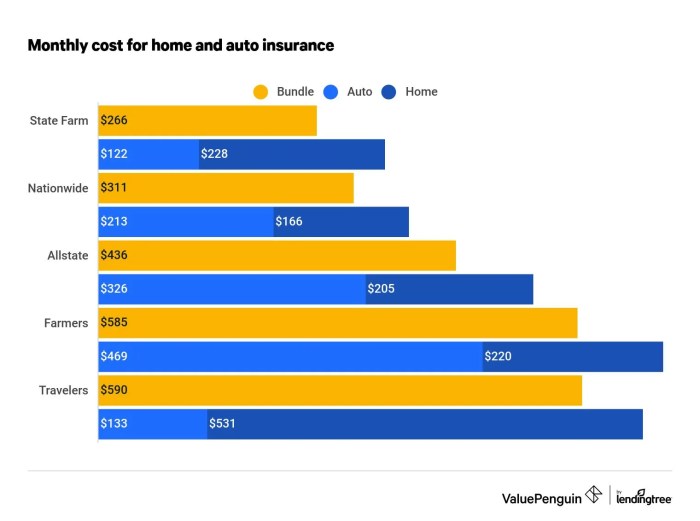

Bundling your home and auto insurance policies typically leads to a reduction in your overall premiums. Insurers offer discounts for bundling because they streamline their administrative processes and reduce the risk associated with managing multiple policies for a single customer. These discounts can vary widely depending on the insurer, the specific policies, and your individual risk profile. The savings can be substantial, potentially amounting to hundreds of dollars annually.

Discount Structures for Bundled Policies

Many insurers offer a percentage discount on your total premium when you bundle home and auto insurance. For example, a company might offer a 10% discount, meaning you would save 10% on the combined cost of your home and auto insurance premiums. Other insurers might offer a fixed dollar amount discount, such as $50 or $100 off your annual premium. Some insurers might even offer tiered discounts, where the discount increases based on the number of policies bundled (e.g., adding an umbrella liability policy could increase the discount). It’s important to compare offers from different insurers to find the best deal.

Examples of Bundled Insurance Discounts

Let’s consider a hypothetical scenario. Suppose your annual home insurance premium is $1200, and your annual auto insurance premium is $800. If an insurer offers a 15% discount for bundling, your combined premium would be ($1200 + $800) * 0.85 = $1700. This represents a savings of $150 compared to purchasing the policies separately ($2000 – $1700 = $150). Alternatively, if the insurer offers a flat $100 discount, your total premium would be $1900. In this case, you’d save $100. These examples highlight the potential for significant savings through bundling.

Non-Financial Benefits of Bundled Insurance

The advantages of bundling extend beyond simple financial savings. There are several non-financial benefits that can significantly improve your insurance experience:

- Simplified Billing: You receive one consolidated bill, making payment easier and reducing the risk of missed payments.

- Single Point of Contact: Dealing with a single insurer simplifies communication and claim processing. If you need to file a claim for either your home or your car, you only need to contact one company.

- Improved Customer Service: Insurers often prioritize their bundled customers, offering enhanced customer service and support.

- Streamlined Renewal Process: Renewing your policies becomes much more efficient with a single renewal date and process.

Policy Comparison and Selection

Choosing the right bundled home and auto insurance policy requires careful consideration of several key factors. A thorough comparison of quotes, coupled with a clear understanding of coverage details, will ensure you secure the best protection at the most competitive price. This process involves more than just looking at the bottom line; it’s about finding a policy that aligns with your specific needs and risk profile.

Key Factors for Comparing Bundled Insurance Quotes

Comparing quotes isn’t simply about finding the cheapest option. Several crucial factors influence the overall value of a bundled policy. These factors should be carefully weighed against each other to determine the best fit.

- Premium Cost: The total annual cost is a primary consideration. However, don’t solely focus on the lowest premium; consider the coverage offered for that price.

- Deductibles: Higher deductibles generally result in lower premiums. Evaluate your financial capacity to cover a higher deductible in the event of a claim.

- Coverage Limits: Understand the limits of liability for both your home and auto insurance. Ensure the limits are sufficient to protect your assets in case of significant damage or liability claims.

- Policy Features: Compare additional features offered, such as roadside assistance, rental car reimbursement, or personal liability coverage extensions. These add-ons can significantly impact the overall value.

- Company Reputation and Financial Stability: Research the insurer’s financial strength and customer satisfaction ratings. A financially stable company is more likely to pay out claims promptly and reliably.

Understanding Policy Coverage and Limitations

It’s crucial to thoroughly review the policy documents to understand exactly what is covered and what is excluded. Failing to do so could lead to unexpected costs in the event of a claim. Pay close attention to:

- Specific Exclusions: Policies often exclude certain types of damage or events. For example, flood damage might require separate flood insurance.

- Coverage Limits and Deductibles: Clearly understand the maximum amount the insurer will pay for a specific claim and your out-of-pocket responsibility.

- Definitions of Covered Events: Policies define specific events and circumstances that trigger coverage. Make sure you understand these definitions.

Negotiating Better Rates

While comparing quotes is essential, don’t be afraid to negotiate. Insurance companies often have some flexibility in their pricing.

- Bundle Services: Bundling home and auto insurance is the most common way to secure a discount, but inquire about additional discounts for other services such as life insurance or umbrella policies.

- Safety Features: Highlight any safety features in your home or car, such as security systems, anti-theft devices, or driver-assistance technologies. These can often lead to lower premiums.

- Payment Options: Paying your premiums annually, rather than monthly, can often result in a small discount.

- Loyalty Discounts: If you’ve been a loyal customer with the same company for many years, inquire about potential loyalty discounts.

- Shop Around: Don’t hesitate to contact multiple insurance providers and compare their quotes and offerings. This competitive approach can often lead to better rates.

Step-by-Step Process for Choosing the Best Bundled Insurance Policy

Selecting the optimal policy involves a systematic approach.

- Gather Information: Collect information about your home and vehicles, including their value, location, and any relevant safety features.

- Obtain Quotes: Get quotes from at least three different insurance providers. Use online comparison tools or contact providers directly.

- Compare Quotes: Carefully compare the quotes, paying close attention to premium costs, deductibles, coverage limits, and policy features. Don’t solely focus on price; consider the overall value.

- Review Policy Documents: Thoroughly read the policy documents for each quote to understand the specific coverage and limitations.

- Negotiate Rates: Attempt to negotiate lower rates with your preferred provider, highlighting any factors that could reduce your risk.

- Make a Decision: Choose the policy that best balances cost, coverage, and your individual needs.

Online Quote Tools and Platforms

The rise of online insurance platforms has revolutionized how consumers obtain quotes, offering convenience and transparency previously unavailable. These tools allow users to compare various insurance providers and policies within minutes, empowering them to make informed decisions based on their specific needs and budgets. Understanding the features, advantages, and security aspects of these platforms is crucial for navigating the insurance market effectively.

Features and Functionalities of Online Quote Comparison Tools

Online quote comparison tools typically offer a streamlined process for obtaining home and auto insurance quotes. Users input basic information such as address, driving history, and desired coverage levels. The platform then searches its database of partnered insurance providers, returning a range of quotes within seconds. Many platforms also include advanced features such as the ability to customize coverage options, add drivers or vehicles, and view policy details. Some even offer the option to purchase a policy directly through the platform, completing the entire process online.

Advantages and Disadvantages of Using Online Platforms

Using online platforms for obtaining insurance quotes offers several key advantages. The most significant is convenience; users can compare quotes from multiple providers at any time, without the need for phone calls or in-person meetings. This saves time and effort. Additionally, online platforms often provide transparent comparisons, allowing users to easily see the differences in coverage and pricing between different providers. However, disadvantages exist. The reliance on algorithms might not capture all the nuances of individual situations, potentially leading to inaccurate or incomplete quotes. Also, the limited personal interaction might leave some users feeling unsupported or unsure about their choices.

Security and Privacy Considerations When Using Online Quote Tools

Security and privacy are paramount when using online platforms to share sensitive personal and financial information. Reputable platforms employ robust security measures, including encryption and data protection protocols, to safeguard user data. However, it’s essential to verify the platform’s security credentials and privacy policy before submitting any information. Look for indicators such as SSL certificates (indicated by a padlock icon in the browser address bar) and clear statements about data usage and protection. Be wary of platforms that request excessive or unnecessary personal information.

Comparison of Online Quote Platforms

The following table compares three popular online quote platforms, highlighting their features, ease of use, and security measures. Note that features and specific security protocols can change, so it’s always advisable to check the latest information on each platform’s website.

| Feature | Platform A (e.g., Insurify) | Platform B (e.g., Policygenius) | Platform C (e.g., The Zebra) |

|---|---|---|---|

| Number of Providers Compared | Many, often dozens | A significant number | A wide range |

| Ease of Use (Rating 1-5, 5 being easiest) | 4 | 5 | 4 |

| Customization Options | High | High | Medium |

| Security Measures (Encryption, Data Protection) | SSL Encryption, Data Privacy Policy | SSL Encryption, Transparent Privacy Policy | SSL Encryption, Detailed Privacy Policy |

| Customer Support | Phone, Email, Chat | Phone, Email | Phone, Email, Chat |

Outcome Summary

Securing the right home and auto insurance coverage shouldn’t be a daunting task. By leveraging the insights and strategies Artikeld in this guide, you can confidently navigate the complexities of bundled insurance, compare quotes effectively, and ultimately find a policy that offers comprehensive protection at a price that suits your financial plan. Remember, proactive planning and informed decision-making are key to achieving long-term financial well-being.

Detailed FAQs

What are the typical discounts offered for bundled home and auto insurance?

Discounts vary by insurer but commonly include multi-policy discounts (bundling), safe driver discounts, and loyalty discounts for long-term customers.

How long does it typically take to get a quote for bundled insurance?

Online quote tools often provide instant quotes. However, contacting an agent may take a little longer, depending on their availability and the complexity of your needs.

Can I bundle insurance if I rent my home instead of owning it?

Yes, many insurers offer bundled renters insurance and auto insurance policies.

What happens if I make a claim on one part of my bundled policy?

A claim on one part of your bundled policy (e.g., auto) may not necessarily affect your rates on the other (e.g., home), but it depends on the specifics of your policy and the insurer’s underwriting practices. Check your policy details.