Protecting a farmer’s livelihood extends beyond bountiful harvests; it encompasses safeguarding the heart of their operation – their home. Farmer home insurance isn’t simply a standard homeowner’s policy; it’s a specialized shield tailored to the unique risks inherent in rural living and agricultural pursuits. This guide delves into the intricacies of securing comprehensive coverage, ensuring peace of mind for those who dedicate their lives to cultivating the land.

From understanding the nuances of coverage for farm dwellings, including barns and outbuildings, to navigating liability issues and selecting the optimal policy, we’ll explore every facet of farmer home insurance. We’ll examine the factors influencing premiums, provide practical advice for choosing the right policy, and detail the claims process. This comprehensive resource equips farmers with the knowledge necessary to make informed decisions and protect their valuable assets.

Defining Farmer Home Insurance

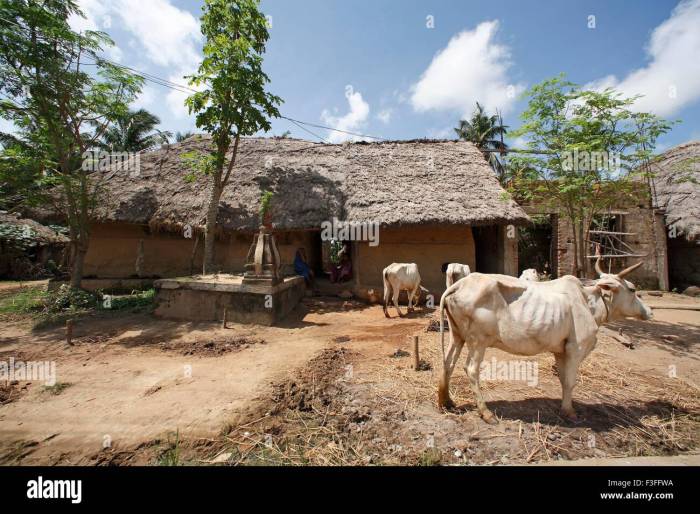

Farmer home insurance is a specialized type of homeowner’s insurance designed to protect the unique assets and risks associated with farming operations. Unlike standard homeowner’s insurance, which primarily covers residential structures and personal belongings, farmer home insurance often incorporates broader coverage to encompass the specific needs of agricultural lifestyles. This includes protection for farm structures, specialized equipment, livestock, and crops, alongside the typical coverage found in a standard policy.

Farmer home insurance policies typically include coverage for dwelling structures (the main farmhouse and other buildings directly related to the home), personal property (furniture, clothing, and other household items), liability (protection against lawsuits stemming from accidents on the property), and additional living expenses (temporary housing costs if the home becomes uninhabitable due to a covered event). However, the crucial distinction lies in the expansion of these coverages to include the unique risks inherent in farming.

Coverage for Farm-Specific Risks

Farmers face a range of risks beyond those faced by typical homeowners. These risks necessitate specialized insurance coverage to mitigate potential financial losses. A standard homeowner’s policy often lacks sufficient coverage for the unique assets and liabilities involved in farming operations. For instance, damage to barns, silos, or other agricultural structures would be covered under a farmer’s home insurance policy, but may be excluded or have limited coverage under a standard policy. Similarly, the loss of livestock due to disease, accident, or theft is a significant concern for farmers, requiring specific insurance coverage not typically found in standard homeowner’s insurance.

Typical Coverage Extensions in Farmer Home Insurance

This specialized insurance often extends coverage to include items such as barns, sheds, fences, livestock, and farm equipment. It also frequently incorporates provisions for crop damage caused by weather events, such as hailstorms or drought. Liability coverage is also expanded to account for potential accidents involving farm animals or visitors to the farm. Furthermore, the policy might include coverage for the loss of income due to crop failure or livestock loss, helping farmers recover from significant financial setbacks.

Unique Risks Requiring Specialized Insurance

The unique risks faced by farmers necessitate the need for specialized insurance. These risks can include: damage or loss to crops from adverse weather conditions (hail, frost, drought, flooding); loss or injury to livestock due to disease, accidents, or theft; damage to or destruction of farm buildings and equipment; liability for injuries or damages caused by farm animals or farm operations; and loss of income due to crop failure or livestock loss. The scale and nature of these risks necessitate a policy tailored specifically to the agricultural context, providing a more comprehensive level of protection than a standard homeowner’s policy.

Choosing the Right Policy

Selecting the right farmer home insurance policy requires careful consideration of your specific needs and circumstances. This involves understanding your property’s value, the potential risks you face, and the coverage options available from different insurers. Failing to adequately assess these factors could lead to insufficient coverage or paying for unnecessary protection.

Finding the best policy is a multi-step process that balances coverage, cost, and the reputation of the insurance provider. It’s important to remember that the cheapest option isn’t always the best, and comprehensive coverage might be worth a slightly higher premium.

Comparing Insurance Providers and Their Offerings

Different insurance providers offer varying levels of coverage, policy terms, and customer service. Some may specialize in insuring specific types of farm properties or livestock, while others offer broader coverage. Key differences often lie in the details of their policies, such as the extent of liability coverage, the types of perils covered, and the deductibles offered. For example, one insurer might offer more comprehensive coverage for barns and outbuildings, while another might prioritize coverage for livestock. Reading the policy documents carefully is crucial to understanding these nuances.

Analyzing Policy Terms and Conditions

A thorough review of policy terms and conditions is essential before committing to a policy. Pay close attention to the definition of covered perils (e.g., fire, wind, hail, theft), exclusions (e.g., flood, earthquake), and the claims process. Understanding the deductible amount—the amount you pay out-of-pocket before the insurance coverage kicks in—is also crucial. Higher deductibles generally lead to lower premiums, but you need to ensure you can comfortably afford the deductible in case of a claim. Consider the insurer’s reputation for prompt and fair claims handling; researching customer reviews and ratings can be beneficial in this regard.

Comparing Insurance Quotes

Once you’ve identified several potential insurers, obtain quotes from each. Make sure you are comparing apples to apples – ensure the quotes cover the same level of protection for the same property and assets. Don’t just focus on the premium; consider the overall value proposition, taking into account the coverage limits, deductibles, and the insurer’s reputation. A slightly higher premium might be worthwhile if it comes with significantly better coverage or a more reliable claims process. Creating a simple comparison table can help you visualize the differences between quotes and make an informed decision. For example, you can list insurers, their premiums, deductibles, coverage limits for your house, outbuildings, and livestock, and their customer satisfaction ratings.

Understanding Policy Exclusions and Limitations

Farmer’s home insurance, while designed to protect your property and livelihood, doesn’t cover every conceivable event. Understanding the limitations and exclusions within your policy is crucial to avoid unexpected financial burdens in the event of a claim. A thorough review before purchasing a policy ensures you’re adequately protected against the risks you face.

It’s important to remember that insurance policies are contracts, and these contracts specify what is and isn’t covered. Ignoring these exclusions can lead to significant disappointment and financial hardship when you need your insurance most. Many exclusions are standard across most policies, while others might vary based on your specific location, the type of coverage you select, and the insurer.

Common Exclusions and Limitations in Farmer Home Insurance

Common exclusions frequently found in farmer’s home insurance policies often relate to events outside the insurer’s control or those deemed preventable through reasonable care. These exclusions are designed to manage risk and ensure the financial viability of the insurance provider. Understanding these common exclusions allows for better preparedness and informed decision-making.

Examples of Uncovered Events

Several events or situations are typically not covered under a standard farmer’s home insurance policy. For example, damage caused by gradual wear and tear, such as roof deterioration from age, is usually excluded. Similarly, damage from floods, earthquakes, or other naturally occurring events often requires separate, supplemental insurance. Insect infestations or damage caused by vermin are also frequently excluded, unless explicitly covered by an added endorsement. Finally, losses due to neglect or intentional acts are typically not covered. Imagine a barn collapsing due to years of deferred maintenance; this would likely be considered an exclusion.

Importance of Understanding Exclusions Before Purchase

Understanding policy exclusions before purchasing insurance is paramount for several reasons.

- Avoid Unnecessary Expenses: Purchasing a policy that doesn’t cover your specific needs is a waste of money.

- Accurate Risk Assessment: Knowing the limitations allows you to assess your true risk exposure and make informed decisions about additional coverage.

- Prevent Financial Hardship: A clear understanding of what’s not covered prevents unexpected financial strain in the event of a loss.

- Ensure Adequate Protection: It enables you to obtain supplemental coverage where needed, ensuring comprehensive protection.

- Avoid Disputes: Clear comprehension prevents potential disputes with the insurance company when filing a claim.

Filing a Claim

Filing a claim with your farmer’s home insurance provider can seem daunting, but understanding the process can make it significantly less stressful. This section details the steps involved in reporting a covered loss or damage to your property and the necessary documentation you’ll need to provide. Remember, prompt action is key to a smooth claims process.

The claims process generally begins with immediate notification to your insurance provider. Following this initial report, you’ll be guided through a series of steps to document the damage and facilitate the assessment and repair or replacement of your property.

Claim Notification

Contact your insurance company as soon as possible after the incident causing the damage. This initial contact usually involves a phone call to their claims hotline, where you will provide basic information about the incident, such as the date, time, and a brief description of what happened. You’ll likely be assigned a claims adjuster who will be your main point of contact throughout the process.

Documentation Requirements

Providing comprehensive documentation is crucial for a successful claim. This typically includes, but is not limited to, photographs or videos of the damaged property from multiple angles, a detailed description of the incident, receipts or other proof of ownership of the damaged items, and any relevant police reports if applicable (such as in the case of theft or vandalism). Maintaining detailed records throughout the process will also be beneficial. For example, keeping copies of all correspondence with your insurance company, including emails and letters.

Claim Assessment and Investigation

Following your initial report, a claims adjuster will likely contact you to schedule an inspection of your property. This inspection allows the adjuster to assess the extent of the damage and determine the appropriate compensation. Cooperate fully with the adjuster during this process; answer all questions honestly and thoroughly, and provide access to the damaged areas of your property. The adjuster will document their findings, which will form the basis of the claim settlement.

Claim Settlement

Once the assessment is complete, your insurance company will review the claim and determine the amount of compensation you’re entitled to. This process may involve negotiations, especially if there are disagreements about the extent of the damage or the value of the lost or damaged property. The settlement may be in the form of a check, direct payment to a repair contractor, or a combination of both. The timeframe for settlement can vary depending on the complexity of the claim and the insurance company’s internal processes. However, you should expect to receive regular updates from your claims adjuster throughout this process.

Illustrative Scenarios

Understanding how farmer’s home insurance works in practice is best achieved through real-world examples. The following scenarios illustrate common claims and the typical insurance response.

Severe Storm Damage to Home and Outbuildings

A powerful thunderstorm, accompanied by torrential rain and high winds, swept across Farmer McGregor’s property. The storm caused significant damage to his farmhouse, including a collapsed portion of the roof, shattered windows, and water damage throughout the interior. His barn sustained considerable damage as well; the roof was partially ripped away, exposing stored hay bales to the elements, and one side wall collapsed. Several smaller outbuildings, including a chicken coop and a shed, were completely destroyed. Farmer McGregor immediately contacted his insurance provider, documenting the damage with photographs and a detailed inventory of the losses. The insurance adjuster visited the property within a few days, assessed the damage, and prepared a comprehensive report. After verifying the extent of the damage against Farmer McGregor’s policy, the insurance company approved his claim, covering the cost of repairs to the farmhouse, replacement of the damaged barn, and compensation for the loss of the outbuildings and the ruined hay. The claim process took approximately six weeks, from initial reporting to the final settlement.

Liability Claim Due to an Accident on the Property

While visiting Farmer Jones’s farm, a city-dwelling friend, Mr. Smith, tripped over an unseen section of exposed wire fencing near the orchard and sustained a broken leg. Mr. Smith sought medical attention and subsequently filed a liability claim against Farmer Jones. Farmer Jones immediately notified his insurance company, providing details of the accident and a copy of Mr. Smith’s claim. The insurance company launched an investigation, interviewing Farmer Jones, Mr. Smith, and any other witnesses. The investigation determined that Farmer Jones had a duty of care to ensure his property was reasonably safe for visitors, and the exposed fencing constituted a breach of that duty. The insurance company settled the claim with Mr. Smith, covering his medical expenses and providing compensation for pain and suffering, without requiring Farmer Jones to admit liability. The settlement amount was within the limits of Farmer Jones’s liability coverage.

Final Summary

Securing adequate farmer home insurance is a crucial investment, offering vital protection against the myriad risks associated with rural living and agricultural operations. By understanding the specific coverage options, factors affecting premiums, and the claims process, farmers can confidently navigate the insurance landscape and find a policy that perfectly aligns with their individual needs. Remember, proactive planning and a thorough understanding of your policy are key to ensuring the long-term security and prosperity of your farm and family.

Answers to Common Questions

What is the difference between farmer’s home insurance and standard homeowner’s insurance?

Farmer’s home insurance covers the unique risks associated with farming, such as damage to barns, silos, and farm equipment, and liability related to farming activities. Standard homeowner’s insurance typically does not include these aspects.

Does my farmer’s home insurance cover livestock?

Coverage for livestock is typically an add-on or a separate policy, not included in standard farmer’s home insurance. Check your policy details for specifics.

What if I have a home-based business related to farming (e.g., processing)?

You’ll need to specifically disclose this to your insurer. Coverage for business-related activities and liability may require additional coverage or endorsements to your policy.

How often should I review my farmer’s home insurance policy?

It’s recommended to review your policy annually, or whenever there are significant changes to your property, farming operations, or assets.