Finding the right home insurance policy can feel like navigating a maze, especially in a large and diverse state like Texas. Understanding the average home insurance cost in Texas is crucial for budgeting and securing adequate protection. This guide delves into the factors influencing premiums, explores various coverage options, and provides practical strategies for finding affordable yet comprehensive insurance, empowering Texas homeowners to make informed decisions.

From the sprawling plains to bustling cityscapes, Texas presents a wide range of housing styles and risk profiles, directly impacting insurance costs. This guide will dissect these variations, providing a clear picture of what to expect based on your location, home type, and coverage needs. We’ll examine the influence of factors like home age, credit score, and claims history, equipping you with the knowledge to negotiate favorable rates and secure the best possible coverage for your valuable asset.

Insurance Coverage Options in Texas

Choosing the right home insurance policy in Texas involves understanding the various coverage options available to protect your property and financial well-being. Several key coverage types are standard, while others are optional additions depending on your specific needs and risk assessment. This section details the common coverage types and the benefits and drawbacks of supplemental options.

Standard Home Insurance Coverage in Texas

Standard Texas home insurance policies typically include dwelling coverage, liability coverage, and personal property coverage. Dwelling coverage protects the physical structure of your home, including attached structures like garages. Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. Personal property coverage protects your belongings inside your home from damage or theft. The amount of coverage for each of these aspects is determined by an assessment of your property’s value and your personal possessions. It’s crucial to ensure your coverage amounts are adequate to rebuild or replace your home and possessions in the event of a loss. Underinsurance can lead to significant financial burdens in the aftermath of a disaster.

Optional Home Insurance Coverage Additions in Texas

While standard coverage is essential, several optional add-ons enhance protection. Flood insurance, for example, is crucial in areas prone to flooding, even if you don’t live in a designated flood zone. Flooding is often excluded from standard home insurance policies. Earthquake insurance is another important consideration, especially in seismically active regions of Texas. Other optional additions might include coverage for personal liability beyond the standard limits, coverage for valuable items (jewelry, art), and coverage for specific events like windstorms or hail damage. These additional coverages come at an extra cost, but they can offer significant peace of mind and financial protection against unexpected events. The decision of whether or not to add these options depends on individual risk tolerance and financial circumstances. Weighing the potential cost of a loss against the premium for the additional coverage is essential.

Comparison of Major Home Insurance Providers in Texas

Choosing the right provider is as important as selecting the right coverage. Price and coverage options vary significantly among insurers. The following table compares three major providers, offering a snapshot of their typical coverage options and average costs (note that actual costs will vary based on individual factors like location, property value, and coverage amounts). Customer reviews provide additional insight into the quality of service each provider offers.

| Provider | Coverage Options | Average Cost (Annual) | Customer Reviews Summary |

|---|---|---|---|

| State Farm | Dwelling, Liability, Personal Property, Flood (optional), Earthquake (optional), Wind/Hail | $1,200 – $2,000 | Generally positive, known for strong customer service and claims handling. |

| Farmers Insurance | Dwelling, Liability, Personal Property, Flood (optional), Earthquake (optional), Personal Umbrella Liability | $1,000 – $1,800 | Mixed reviews; some praise the ease of claims, while others cite issues with customer service responsiveness. |

| USAA | Dwelling, Liability, Personal Property, Flood (optional), Earthquake (optional), Valuable Items Coverage | $1,100 – $1,900 | Highly positive reviews, particularly among military members and their families, known for excellent claims service and competitive pricing. |

End of Discussion

Securing affordable and comprehensive home insurance in Texas is a critical step in protecting your biggest investment. By understanding the factors that influence premiums, exploring various coverage options, and utilizing the strategies Artikeld in this guide, Texas homeowners can confidently navigate the insurance market and find a policy that aligns perfectly with their needs and budget. Remember, proactive planning and informed decision-making are key to safeguarding your home and peace of mind.

Commonly Asked Questions

What is the impact of my location on my home insurance premium in Texas?

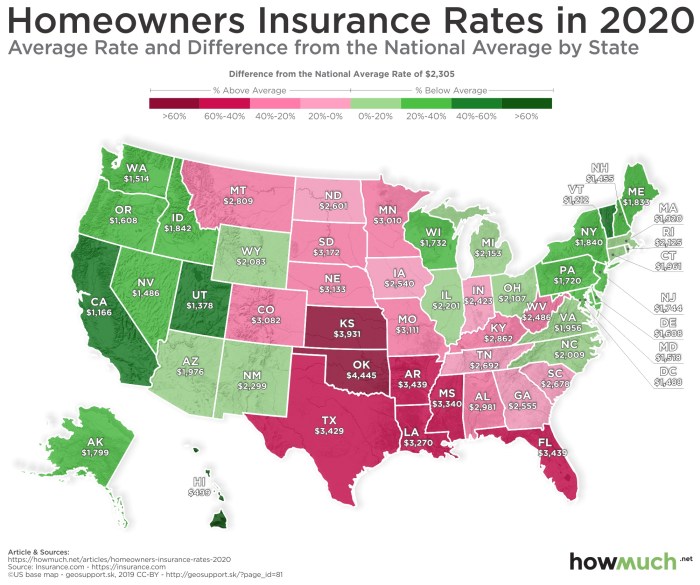

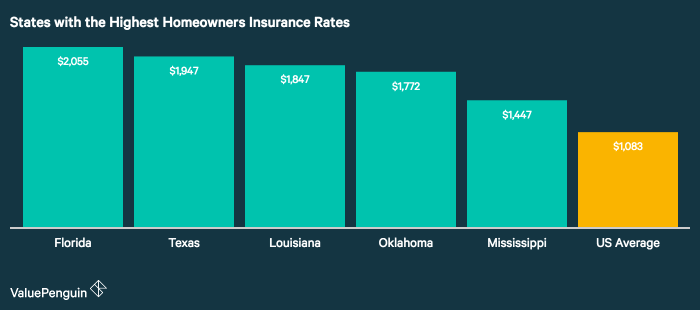

Premiums vary significantly across Texas due to factors like crime rates, natural disaster risk (e.g., hurricanes, hail), and the density of the area. Coastal regions generally have higher premiums than inland areas.

How often should I review my home insurance policy?

It’s recommended to review your policy annually, or whenever there’s a significant change in your circumstances (e.g., home improvements, changes in your financial situation).

Can I bundle my home and auto insurance for a discount?

Yes, many insurance providers offer discounts for bundling home and auto insurance policies. Contact your insurer to see if this option is available.

What is the role of my credit score in determining my home insurance premium?

In many states, including Texas, your credit score is a factor in determining your insurance premium. A higher credit score typically results in lower premiums.