Securing your home is a significant investment, and understanding the associated costs is crucial. The average homeowner insurance cost varies dramatically depending on a multitude of factors, making it a complex topic to navigate. This guide delves into the intricacies of homeowner insurance pricing, providing insights into the elements that influence premiums and offering practical strategies for securing affordable coverage.

From geographical location and property characteristics to individual risk profiles and coverage choices, numerous variables play a role in determining your insurance premium. We’ll explore these factors in detail, equipping you with the knowledge to make informed decisions about protecting your most valuable asset.

Factors Influencing Homeowner Insurance Costs

Homeowner insurance premiums are not a one-size-fits-all proposition. Several interconnected factors contribute to the final cost, making it crucial for homeowners to understand these elements to secure the best possible coverage at a reasonable price. This section will delve into the key determinants of your homeowner’s insurance premium.

Home Location

Your home’s location significantly impacts your insurance costs. Areas prone to natural disasters, such as hurricanes, earthquakes, wildfires, or floods, command higher premiums due to the increased risk. Similarly, neighborhoods with high crime rates may also result in elevated premiums as the risk of theft or vandalism increases. Conversely, homes in low-risk areas generally enjoy lower premiums.

| Factor | Impact on Cost | Example |

|---|---|---|

| Location (High-Risk Area) | Higher Premiums | Home in a coastal region prone to hurricanes |

| Location (Low-Risk Area) | Lower Premiums | Home in a rural area with low crime rates and minimal natural disaster risk |

Age and Condition of the Home

Older homes, particularly those lacking modern safety features like updated electrical systems or plumbing, tend to carry higher insurance premiums. This is because older structures are more susceptible to damage and require more extensive repairs. Regular maintenance and upgrades can mitigate this risk and potentially lower premiums. A well-maintained home with recent renovations will generally be considered less risky by insurance companies.

| Factor | Impact on Cost | Example |

|---|---|---|

| Older Home (Poor Condition) | Higher Premiums | A 70-year-old home with outdated electrical wiring and a leaky roof |

| Newer Home (Excellent Condition) | Lower Premiums | A newly constructed home with modern safety features and regular maintenance |

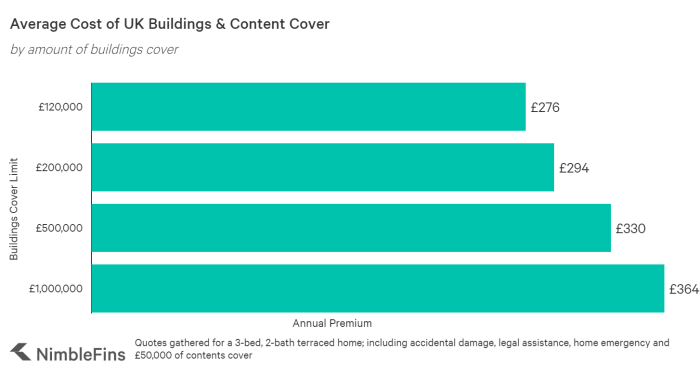

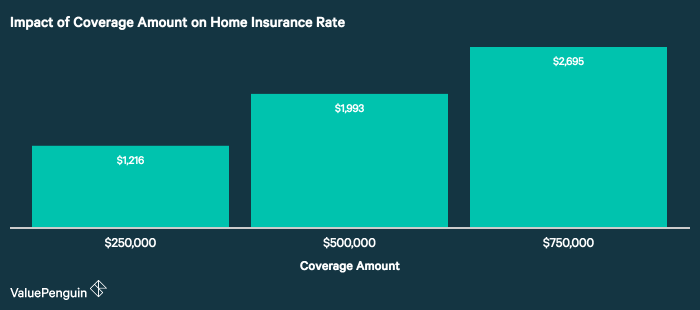

Coverage Levels

The amount of coverage you choose directly impacts your premium. Higher coverage limits for dwelling, personal property, and liability protection result in higher premiums. While comprehensive coverage offers greater financial protection, it comes at a higher cost. Homeowners must carefully weigh the level of risk they are willing to accept against the cost of insurance.

| Factor | Impact on Cost | Example |

|---|---|---|

| High Coverage Limits | Higher Premiums | $500,000 dwelling coverage, $250,000 liability coverage |

| Lower Coverage Limits | Lower Premiums | $300,000 dwelling coverage, $100,000 liability coverage |

Individual Risk Profiles

Insurance companies assess individual risk profiles to determine premiums. Factors such as claims history, safety features (e.g., security systems, smoke detectors), and even the presence of pets can influence the cost. A history of claims will likely lead to higher premiums, while the presence of safety features may result in discounts.

| Factor | Impact on Cost | Example |

|---|---|---|

| Claims History (Multiple Claims) | Higher Premiums | Homeowner with two previous claims in the past five years |

| Safety Features (Security System) | Lower Premiums | Homeowner with a monitored security system and smoke detectors |

Credit Score’s Role in Determining Insurance Rates

Your credit score plays a significant role in determining your homeowner’s insurance premium. Insurance companies often use credit-based insurance scores to assess risk. A higher credit score generally indicates lower risk and thus, lower premiums.

A lower credit score can significantly increase your insurance costs. Conversely, maintaining a good credit score can lead to substantial savings on your premiums.

- Excellent Credit (750+): May qualify for significant discounts and the lowest premiums.

- Good Credit (700-749): Likely to receive moderate discounts.

- Fair Credit (650-699): May see only minor discounts or pay slightly higher premiums.

- Poor Credit (Below 650): Expect significantly higher premiums, potentially facing difficulty securing coverage.

Impact of Different Coverage Options

Different coverage options impact the overall cost. Liability coverage protects you financially if someone is injured on your property. Dwelling coverage protects the structure of your home, while personal property coverage protects your belongings. Comprehensive coverage, including all these aspects, will be more expensive than a policy with limited coverage. Choosing the right balance of coverage is essential to secure adequate protection without incurring unnecessary costs.

Final Thoughts

Ultimately, securing affordable yet comprehensive homeowner insurance requires careful planning and research. By understanding the factors that influence premiums, comparing quotes from different providers, and exploring available discounts, homeowners can effectively manage their insurance costs and safeguard their homes. Remember, a little proactive effort can translate into significant long-term savings and peace of mind.

Helpful Answers

What is the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) covers the replacement cost minus depreciation, while replacement cost covers the full cost of replacing damaged items without considering depreciation.

How often can I expect my homeowner’s insurance rates to change?

Rates can change annually, or even more frequently, depending on your insurer and any changes in your risk profile (e.g., claims, improvements to your home).

Can I get homeowner’s insurance if I have a poor credit score?

Yes, but you’ll likely pay higher premiums. Many insurers use credit scores as a factor in determining risk.

What should I do if I’m unhappy with my current homeowner’s insurance rate?

Shop around for quotes from other insurers and consider negotiating with your current provider. Highlight any improvements you’ve made to your home that reduce risk.