Navigating the world of home insurance can feel like deciphering a complex code. Finding the right coverage at the best price requires careful consideration of numerous factors, from policy details to insurer reputation. This guide empowers you to confidently compare home insurance quotes, ensuring you secure the protection your home deserves without overspending.

We’ll break down the process step-by-step, from understanding the components of a quote and identifying reliable sources to deciphering the jargon and making informed decisions based on your specific needs. By the end, you’ll be equipped to compare quotes effectively, ultimately securing a policy that offers both comprehensive coverage and exceptional value.

Understanding Home Insurance Quotes

A home insurance quote provides an estimate of the cost to insure your property. Understanding these quotes is crucial for securing adequate protection at a competitive price. This section will break down the key elements of a home insurance quote and the factors that influence its cost.

Home Insurance Quote Components

A typical home insurance quote includes several key components. Firstly, it specifies the coverage amounts offered for different aspects of your home and belongings. This includes dwelling coverage (the structure of your house), personal property coverage (your belongings inside), liability coverage (protecting you against lawsuits), and additional living expenses (covering temporary housing if your home becomes uninhabitable). Secondly, the quote details the premium, which is the amount you’ll pay periodically (monthly, annually, etc.) for the coverage. Finally, it Artikels any deductibles, which are the amounts you’ll pay out-of-pocket before your insurance coverage kicks in. The quote might also specify policy limits, which represent the maximum amount the insurer will pay for a covered loss.

Factors Influencing Home Insurance Costs

Several factors influence the cost of home insurance. Your location plays a significant role, as areas prone to natural disasters (earthquakes, hurricanes, wildfires) typically command higher premiums. The age and condition of your home also matter; older homes may require more expensive repairs, leading to higher premiums. The value of your home and its contents directly impacts the coverage needed and therefore the cost. Your credit score can also be a factor, with better scores often leading to lower premiums. Finally, the type and amount of coverage you choose significantly influence the overall cost. For example, choosing a higher deductible will generally lower your premium, while opting for comprehensive coverage will increase it.

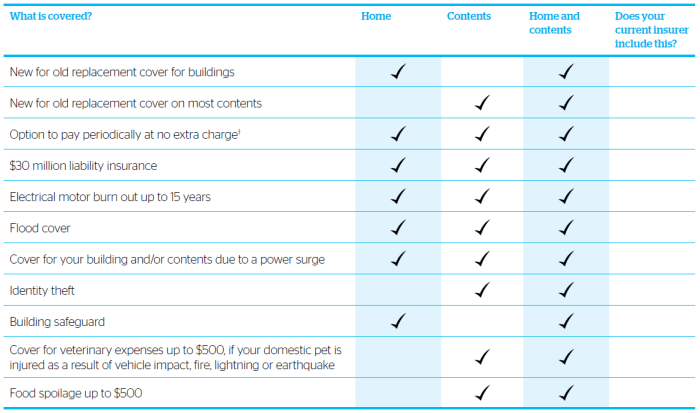

Types of Home Insurance Coverage

Home insurance policies offer various coverage options to protect your property and financial interests. These options allow you to customize your policy to meet your specific needs and budget. Common coverage types include dwelling coverage, personal property coverage, liability coverage, and additional living expenses. Some policies also offer specialized coverage for things like valuable items, water damage, or specific natural disasters. The level of coverage selected impacts the premium. For instance, a policy offering higher liability limits will generally be more expensive than one with lower limits.

Comparison of Common Home Insurance Coverage Options

| Coverage Type | What it Covers | Typical Deductible | Premium Impact |

|---|---|---|---|

| Dwelling Coverage | Damage to the structure of your home (e.g., fire, wind damage) | Varies (e.g., $500 – $2,000) | High (significant portion of the premium) |

| Personal Property Coverage | Your belongings inside your home (e.g., furniture, electronics) | Varies (e.g., $500 – $2,000) | Moderate (substantial portion of the premium) |

| Liability Coverage | Legal costs and damages if someone is injured on your property | Generally no deductible for liability claims | Moderate (a notable portion of the premium) |

| Additional Living Expenses | Temporary housing, food, and other expenses if your home is uninhabitable | Varies (often the same as dwelling or personal property deductible) | Low to Moderate (depends on policy limits) |

Sources for Obtaining Home Insurance Quotes

Finding the best home insurance can feel overwhelming, but understanding your options for obtaining quotes is the first step. There are several avenues you can explore, each with its own set of advantages and disadvantages. Choosing the right method depends on your comfort level with technology, your time constraints, and your preference for personal interaction.

Methods for Obtaining Home Insurance Quotes

Three primary methods exist for obtaining home insurance quotes: online comparison websites, working directly with an insurance agent, and utilizing the services of an independent insurance broker. Each approach offers a unique set of benefits and drawbacks.

Online Comparison Websites

Online comparison websites aggregate quotes from multiple insurance providers, allowing you to easily compare prices and coverage options side-by-side. This method offers convenience and speed, often providing instant quotes without requiring extensive personal interaction.

- Advantages: Quick and easy comparison of multiple insurers; convenient access at any time; often provides instant quotes.

- Disadvantages: May not include all insurers in your area; can be difficult to compare coverage details precisely due to variations in policy wording; lacks the personalized guidance of a human agent.

Insurance Agents

Insurance agents represent a single insurance company. They provide personalized service, guiding you through the process and helping you choose a policy that best fits your needs. This approach offers expert advice and a direct line of communication with the insurer.

- Advantages: Personalized service and guidance; access to specialized knowledge and expertise; easier claims process due to direct contact with the insurer.

- Disadvantages: Limited choice of insurers; may not offer the most competitive prices; requires more time commitment due to in-person or phone consultations.

Independent Insurance Brokers

Independent insurance brokers work with multiple insurance companies, allowing them to compare quotes from a broader range of providers. They act as advocates for their clients, negotiating the best possible terms and coverage. This approach combines the personalized service of an agent with the broader selection of an online comparison website.

- Advantages: Access to a wider range of insurers and policies; personalized advice and negotiation on your behalf; potential for better rates due to competitive bidding between insurers.

- Disadvantages: May require more time and effort to find the right broker; broker fees may apply (though often negligible); the broker’s expertise can vary.

Information Typically Requested When Obtaining a Quote

Before providing a quote, insurers will typically require a substantial amount of information about your property and your circumstances. Providing accurate and complete information is crucial to receiving an accurate quote and ensuring your policy adequately protects your home.

- Property details: Address, year built, square footage, type of construction (e.g., brick, wood), number of bedrooms and bathrooms.

- Coverage needs: Desired coverage amounts for dwelling, personal property, liability, and other optional coverages (e.g., flood, earthquake).

- Personal information: Name, address, date of birth, contact information.

- Claim history: Details of any previous insurance claims.

- Security features: Presence of security systems (e.g., alarm, security cameras).

Factors to Consider Beyond Price

Securing the best home insurance quote isn’t solely about finding the lowest premium. A comprehensive assessment requires looking beyond the price tag to ensure you’re choosing a policy and provider that offer the right level of protection and peace of mind. Several crucial factors influence the overall value and effectiveness of your home insurance, impacting your experience should you need to file a claim.

The importance of considering factors beyond price cannot be overstated. While a low premium is attractive, it’s crucial to balance cost with the quality of coverage and the insurer’s reliability. A seemingly cheap policy from a financially unstable company could leave you vulnerable in the event of a significant loss.

Insurer Financial Stability and Claims Handling

Understanding an insurer’s financial strength is paramount. A financially sound company is more likely to be able to pay out claims promptly and without issue, even in the event of widespread damage from a natural disaster. You can research an insurer’s financial stability through independent rating agencies like A.M. Best, Moody’s, and Standard & Poor’s. These agencies assess insurers based on their financial reserves, claims-paying ability, and overall operational strength. A high rating from these agencies indicates a greater likelihood of claim fulfillment. Additionally, researching the insurer’s claims handling process, including customer reviews and independent reports on claim settlement times and customer satisfaction, provides valuable insights into their efficiency and responsiveness during a time of need. Look for insurers with a reputation for fair and efficient claim settlements. Examples of poor claims handling could include excessively long processing times, unreasonable claim denials, or difficult communication with adjusters.

Policy Coverage and Exclusions

A thorough review of the policy’s coverage details is critical. Don’t just focus on the premium; carefully examine what’s included and excluded. Consider whether the coverage limits are sufficient for your home’s replacement cost and personal belongings. Pay close attention to exclusions – specific events or circumstances not covered by the policy. For instance, some policies may exclude flood or earthquake damage, requiring separate coverage. Understanding these exclusions allows you to make informed decisions and potentially purchase supplemental coverage if necessary. Comparing policies with similar premiums but different coverage levels can highlight significant variations in value.

Customer Service and Accessibility

Easy access to customer service is crucial, particularly during a stressful claim process. Consider how easily you can contact the insurer, whether through phone, email, or online chat. Look for insurers with readily available customer support and positive customer reviews regarding responsiveness and helpfulness. A positive customer service experience can significantly ease the burden during a difficult time. Conversely, poor customer service can exacerbate an already stressful situation. Think about the potential inconvenience of dealing with an unresponsive insurer during a critical moment, such as after a major storm.

Additional Policy Features

Beyond basic coverage, explore additional features offered by different insurers. These may include things like discounts for security systems, replacement cost coverage (covering the cost to rebuild or replace your home at current prices, rather than its depreciated value), and guaranteed replacement cost (which goes beyond replacement cost coverage by promising to cover even if the actual cost exceeds the coverage limit). These features can add significant value to your policy and provide additional protection beyond the basic coverage. Weigh the cost of these features against their potential benefits to determine if they align with your risk tolerance and financial situation.

Summary

Successfully comparing home insurance quotes is a crucial step in protecting your most valuable asset. By understanding the intricacies of policy coverage, leveraging various quote sources, and carefully considering factors beyond price, you can confidently choose a policy that provides peace of mind and financial security. Remember, taking the time to compare and understand your options will pay dividends in the long run, safeguarding your home and your financial future.

General Inquiries

What is a deductible, and how does it affect my insurance costs?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums (monthly payments), while lower deductibles mean higher premiums. Choosing the right deductible involves balancing cost and risk tolerance.

How long does it take to get a home insurance quote?

The time it takes to receive a quote varies depending on the method used. Online quotes are often instantaneous, while quotes from agents or brokers may take a few days.

Can I cancel my home insurance policy at any time?

Generally, yes, you can cancel your policy, but there may be penalties or fees depending on your policy terms and the reason for cancellation. Check your policy documents for specific details.

What happens if my insurer goes bankrupt?

Most states have guaranty associations that will step in to cover claims if your insurer becomes insolvent, though there might be limitations on the amount covered.