Owning a home is a significant achievement, a testament to years of hard work and financial planning. However, the joy of homeownership can quickly turn to despair if unforeseen events like fire, windstorms, or hail damage strike. This is where hazard insurance for your home becomes crucial, acting as a financial safety net against the unexpected. Understanding the intricacies of this vital insurance type is paramount to safeguarding your investment and peace of mind.

This guide delves into the essential aspects of hazard insurance, from defining its core components and comparing it to other home insurance types to navigating the process of selecting a policy and minimizing potential risks. We’ll explore factors influencing premium costs, clarify coverage and exclusions, and illustrate real-world scenarios to provide a clear and comprehensive understanding of how this insurance protects your most valuable asset.

Defining Hazard Insurance for Homes

Hazard insurance, often a component of a homeowner’s insurance policy, protects your home and its contents from damage caused by specific perils. It’s crucial for safeguarding your financial investment in your property. Understanding its components and differentiating it from other types of home insurance is vital for adequate protection.

Core Components of a Hazard Insurance Policy

A typical hazard insurance policy covers damage to the structure of your home and its attached structures (like a garage) as well as personal belongings within. Coverage limits are usually specified in the policy and represent the maximum amount the insurer will pay for covered losses. Deductibles, the amount you pay out-of-pocket before insurance coverage begins, are also a key component. Additional living expenses (ALE) coverage may also be included, providing funds for temporary housing and living costs if your home becomes uninhabitable due to a covered peril. Finally, liability coverage can protect you financially if someone is injured on your property.

Differences Between Hazard Insurance and Other Home Insurance Types

Hazard insurance primarily focuses on damage from sudden and unforeseen events, unlike other types of home insurance that address different risks. For instance, it differs significantly from flood insurance, which specifically covers damage caused by flooding, and earthquake insurance, which addresses earthquake-related damage. These are often purchased separately as endorsements or add-ons to a standard hazard policy because most standard policies exclude these perils. Other types of home insurance may include liability coverage (protecting you from lawsuits) and medical payments coverage (covering medical expenses for injuries on your property). Each policy type addresses specific risks, and a comprehensive approach may require multiple policies.

Common Perils Covered Under a Standard Hazard Insurance Policy

Standard hazard insurance policies typically cover a range of perils, though specific coverage can vary by insurer and policy. Commonly covered perils include fire, windstorms, hail, lightning strikes, vandalism, and theft. However, it’s crucial to carefully review your policy to understand the exact perils covered and any exclusions. For example, while fire damage is typically covered, damage resulting from a faulty appliance might not be, depending on the specific policy wording. Similarly, some policies may have limits on coverage for certain types of damage, like flooding from a burst pipe.

Comparison of Hazard, Flood, and Earthquake Insurance

| Coverage | Exclusions | Premiums | Claim Process |

|---|---|---|---|

| Damage to home structure and contents from covered perils (fire, wind, hail, etc.) | Flood, earthquake, gradual damage, neglect | Varies based on location, coverage amount, and risk factors. Generally lower than flood or earthquake insurance. | File a claim with your insurer, provide documentation of damage, and undergo an assessment. |

| Damage from flooding | Damage from other perils, unless specified in a separate policy. | Significantly higher than hazard insurance due to the high risk of flooding in many areas. | Similar to hazard insurance, but may involve FEMA involvement in some cases. |

| Damage from earthquakes | Damage from other perils, unless specified in a separate policy. | Can be expensive, especially in high-risk seismic zones. | Similar to hazard insurance, but the assessment of earthquake damage can be more complex. |

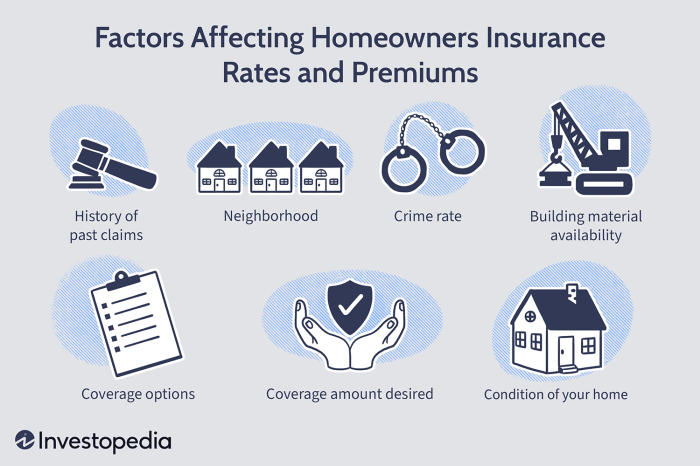

Factors Affecting Home Hazard Insurance Premiums

Several interconnected factors influence the cost of hazard insurance for your home. Insurance companies utilize a complex assessment process to determine premiums, balancing risk assessment with competitive pricing strategies. Understanding these factors can help homeowners better understand their insurance costs and potentially find ways to reduce them.

Location’s Impact on Premiums

Geographic location significantly impacts hazard insurance premiums. Areas prone to natural disasters, such as hurricanes, earthquakes, wildfires, or floods, command higher premiums due to the increased risk of property damage. For instance, a home situated in a coastal region frequently hit by hurricanes will likely have a much higher premium than a similar home located inland in a region with minimal natural disaster risk. Furthermore, the proximity to fire-prone areas, fault lines, or floodplains is carefully considered. Insurance companies utilize sophisticated mapping and risk modeling techniques to pinpoint these high-risk zones, directly influencing the final premium. This risk assessment is often reflected in detailed maps showing varying levels of risk across a given area.

Age and Condition of the Home

The age and condition of a home are crucial factors in determining insurance premiums. Older homes, especially those lacking modern safety features or with outdated building materials, are generally considered higher risk. For example, a home with outdated electrical wiring or a leaky roof presents a greater potential for damage and thus a higher premium. Conversely, newer homes built to modern building codes often qualify for lower premiums due to their improved safety and structural integrity. Regular maintenance and upgrades, such as replacing a dated roof or installing a modern security system, can also positively influence premium calculations. Insurance companies often require inspections to assess the home’s condition and determine the appropriate premium.

Premium Calculation Methods Across Providers

Different insurance providers employ varying methods for calculating premiums, although the underlying principles remain consistent. While all insurers consider the factors discussed above, the weight assigned to each factor, as well as the specific algorithms used, can vary considerably. Some insurers might place greater emphasis on credit scores, while others might prioritize the age of the home’s plumbing or roofing systems. This variance in methodologies leads to a range of premiums for similar properties across different insurance companies. Comparing quotes from multiple providers is therefore essential to secure the most favorable rate. Some companies may also offer discounts for specific features, such as fire-resistant roofing materials or security systems, further highlighting the variability in premium calculation methods.

Understanding Policy Coverage and Exclusions

Home hazard insurance policies are designed to protect homeowners from financial losses due to unforeseen events. However, it’s crucial to understand exactly what is and isn’t covered to avoid disappointment during a claim. This section clarifies the scope of coverage and common exclusions within a typical hazard insurance policy.

Understanding the specific details of your policy is paramount. While policies share similarities, variations exist depending on the insurer, location, and the specifics of your home and coverage selections. Always refer to your policy document for definitive information.

Covered Damages Examples

Hazard insurance typically covers damage caused by a wide range of perils. For example, damage resulting from fire, windstorms, hail, lightning strikes, explosions, and even some instances of water damage (excluding flood damage, which usually requires separate flood insurance) are commonly covered. Imagine a scenario where a severe thunderstorm causes significant damage to your roof. If your policy covers wind damage, the repair costs would likely be reimbursed. Similarly, if a fire erupts in your kitchen and causes structural damage and loss of possessions, your hazard insurance would likely cover the costs of repairs and replacement of your belongings (up to the policy limits). Another example would be damage caused by a falling tree during a high-wind event, impacting your house’s structure or causing damage to your car parked on your property.

Common Policy Exclusions

It’s equally important to be aware of what your policy typically *doesn’t* cover. Many standard hazard insurance policies exclude damages caused by floods, earthquakes, and acts of war or terrorism. Furthermore, damage resulting from neglect, normal wear and tear, or intentional acts are generally not covered. For example, damage from a slowly leaking pipe that is ignored for months, leading to significant water damage, is unlikely to be covered. Similarly, damage caused by pests like termites, or foundation settling due to poor initial construction, are often excluded. Policies also frequently exclude losses resulting from mold, unless the mold growth is a direct consequence of a covered peril, such as a burst pipe.

Filing a Hazard Insurance Claim

The claims process typically involves contacting your insurance provider immediately after the damage occurs. You will usually need to provide detailed information about the incident, including photographs and documentation of the damage. An adjuster will then be assigned to assess the damage and determine the extent of the coverage. Following the assessment, the insurance company will issue a settlement, which may cover the cost of repairs, replacement of damaged property, or both, depending on the policy and the extent of the damage. The exact process might vary slightly depending on your insurer, but the general steps remain consistent.

Hypothetical Scenario: Covered and Excluded Claims

Let’s consider a scenario where a homeowner experiences two separate incidents. First, a severe hailstorm damages their roof, causing significant leaks and requiring extensive repairs. This damage is likely covered under a standard hazard insurance policy as hail damage is a commonly covered peril. Secondly, the homeowner discovers extensive termite damage to the foundation of their home, requiring significant structural repairs. This damage is likely excluded from coverage because termite damage is typically not covered under standard hazard insurance policies unless it is directly linked to a covered event (such as a covered water damage that created a favorable environment for termites).

Illustrative Examples of Hazard Insurance Claims

Understanding how hazard insurance works in practice is crucial. The following examples illustrate common claim scenarios, outlining the process from initial damage to final payout. Remember that specific coverage and claim procedures vary depending on your policy and insurer.

Fire Damage Claim

Let’s consider a scenario where a homeowner’s kitchen catches fire due to a faulty appliance. The fire causes significant damage to the kitchen, including structural damage to the walls and ceiling, destruction of appliances and cabinets, and smoke damage throughout the house. The homeowner immediately contacts their insurance provider, reporting the incident and providing details of the damage. The insurer then dispatches an adjuster to assess the damage, taking photographs and documenting the extent of the loss. The adjuster will determine the cost of repairs or replacement, considering factors such as the age and condition of the damaged property, and the prevailing market prices for materials and labor. After the assessment, the insurance company prepares a settlement offer, which may cover the cost of repairs, temporary housing (if necessary), and potentially additional living expenses incurred during the repair period. The homeowner reviews the offer and can negotiate if needed. Upon acceptance, the insurer releases the funds to either the homeowner or directly to the contractors undertaking the repairs.

Wind Damage Claim

Imagine a severe thunderstorm with high winds causes significant damage to a home’s roof. Several shingles are ripped off, exposing the underlying structure to the elements, and a section of the siding is torn away. The homeowner, after securing the damaged areas as best they can, reports the damage to their insurance company. An adjuster is sent to inspect the damage, assessing the extent of the wind damage and determining the cost of repairs. This will involve replacing damaged shingles, repairing or replacing the siding, and potentially addressing any interior water damage resulting from the roof leak. The claim process follows a similar pattern to the fire damage scenario, with the insurer providing a settlement offer based on the adjuster’s assessment. The homeowner will need to provide documentation such as photos and receipts for any temporary repairs undertaken.

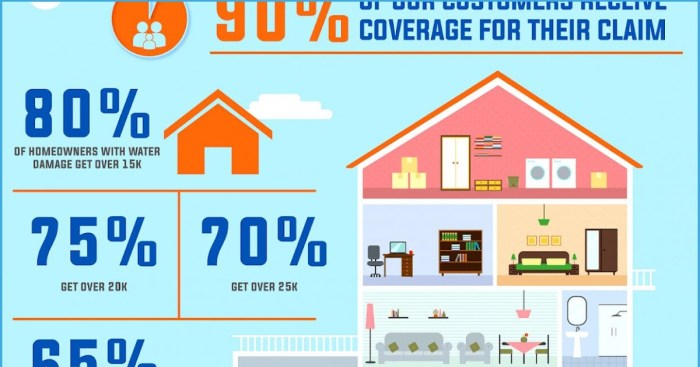

Water Damage Claim (Burst Pipe)

A homeowner returns home to find significant water damage in their basement due to a burst pipe. The water has seeped into the walls, flooring, and personal belongings stored in the basement. The homeowner immediately shuts off the water main and begins to mitigate further damage by removing standing water and opening windows for ventilation. They then contact their insurance company, reporting the incident and providing details of the damage. The adjuster will assess the damage, determining the extent of water damage to the structure and personal belongings. Coverage may vary depending on the policy; some policies cover the cost of repairs and replacement of damaged property, including structural repairs, flooring replacement, and cleanup, while others may have limits on coverage for personal belongings. The claim process will involve providing documentation of the damage, including photographs, receipts for mitigation efforts, and potentially appraisals for damaged personal belongings. The insurer will then issue a settlement offer based on the assessment and the policy’s coverage limits.

Visual Representation of Covered Damages

Imagine a house divided into sections: the roof, the walls, the foundation, and the interior.

* Roof: Shows damage from wind, hail (dents and cracks), and fire (burn marks and structural damage). These are typically covered.

* Walls: Depicts water stains from a burst pipe, cracks from foundation settling (if covered by the policy), and burn marks from a fire. These are usually covered, subject to policy terms.

* Foundation: Illustrates cracks from shifting ground or settling. Coverage depends on the specific policy.

* Interior: Shows water damage from a burst pipe, smoke damage from a fire, and damage to personal belongings from a covered peril. Coverage varies based on the policy and the nature of the damage.

Closing Summary

Protecting your home from the unpredictable is a responsibility that shouldn’t be taken lightly. A thorough understanding of hazard insurance, as Artikeld in this guide, empowers homeowners to make informed decisions, choose the right policy, and ultimately secure their financial future. By proactively mitigating risks and understanding the nuances of coverage and claims, you can transform the potential anxieties associated with homeownership into a sense of security and confidence. Remember, a well-chosen hazard insurance policy is more than just a contract; it’s an investment in the peace of mind that comes with knowing you’re prepared for whatever life throws your way.

FAQ Corner

What is the difference between hazard insurance and homeowner’s insurance?

Hazard insurance typically covers damage to the structure of your home from perils like fire, wind, and hail. Homeowner’s insurance is broader, often including liability coverage, personal property coverage, and sometimes hazard insurance as a component.

How often should I review my hazard insurance policy?

Annually, or whenever there are significant changes to your home, such as renovations or additions. This ensures your coverage remains adequate.

Can I get hazard insurance if I have a mortgage?

Yes, most mortgage lenders require hazard insurance to protect their investment in your home.

What factors influence the deductible amount?

The deductible amount is usually chosen by the homeowner and influences the premium; a higher deductible typically leads to a lower premium.

What happens if I don’t have hazard insurance and my home is damaged?

You would be responsible for all repair or replacement costs yourself, potentially leading to significant financial hardship.