Securing the right home insurance is crucial, and understanding the intricacies of quotes is the first step. This guide delves into the world of home insurance quotes, explaining everything from the factors influencing their cost to the essential elements within each quote. We’ll navigate the process of obtaining, comparing, and interpreting quotes, empowering you to make informed decisions and find the best coverage for your needs.

From understanding coverage types and limits to negotiating premiums, we aim to demystify the often-complex language and processes involved in securing home insurance. This comprehensive guide provides a clear and concise overview, equipping you with the knowledge to confidently navigate the world of home insurance quotes and secure the best possible protection for your home.

Understanding Home Insurance Quotes

Obtaining a home insurance quote is a crucial first step in protecting your most valuable asset. A quote provides a detailed estimate of the cost of insuring your home and its contents against various risks. Understanding the components of a quote allows you to make informed decisions about your coverage and budget.

Home Insurance Quotes: Definition and Importance

A home insurance quote is a detailed estimate of the premium you will pay for a specific home insurance policy. It Artikels the coverage offered, the deductible you’ll have to pay in case of a claim, and the overall cost. The importance of obtaining multiple quotes lies in comparing different providers and coverage options to find the best value for your needs. This ensures you receive adequate protection at a competitive price, avoiding both underinsurance and overspending.

Factors Influencing Home Insurance Quote Costs

Several factors significantly impact the cost of your home insurance quote. These include the location of your property (risk of natural disasters, crime rates), the age and condition of your home (structural integrity, building materials), the coverage amount you select (higher coverage generally means higher premiums), your deductible (a higher deductible lowers your premium but increases your out-of-pocket expenses), your claims history (past claims can lead to higher premiums), and the presence of security features (alarms, fire suppression systems) which can lower your premium. For example, a home in a flood-prone area will generally command a higher premium than a similar home in a less risky location.

Types of Home Insurance Coverage

Home insurance quotes typically include several types of coverage. Dwelling coverage protects the physical structure of your home; personal property coverage protects your belongings inside the home; liability coverage protects you from financial responsibility if someone is injured on your property; additional living expenses coverage covers temporary housing and living costs if your home becomes uninhabitable due to a covered event; and loss of use coverage protects you against financial loss incurred due to an insured event that makes your property temporarily unusable. The specific coverage amounts and details vary depending on the insurer and the policy chosen.

Common Exclusions in Home Insurance Quotes

It’s essential to understand what is *not* covered by your home insurance. Common exclusions often include damage caused by floods (unless specifically added as an endorsement), earthquakes (similarly, requires separate coverage), normal wear and tear, intentional acts, and certain types of pests. Carefully reviewing the policy document is vital to understanding these exclusions and considering supplemental coverage if needed. For instance, many standard policies exclude coverage for damage from sewer backups, necessitating separate coverage for this specific risk.

Comparison of Home Insurance Quotes

The following table compares quotes from three hypothetical insurance providers, highlighting the differences in premium costs and coverage features. Remember, these are illustrative examples and actual quotes will vary based on individual circumstances.

| Insurance Provider | Annual Premium | Deductible | Coverage Limits (Dwelling) |

|---|---|---|---|

| Provider A | $1200 | $1000 | $300,000 |

| Provider B | $1500 | $500 | $350,000 |

| Provider C | $1100 | $1500 | $250,000 |

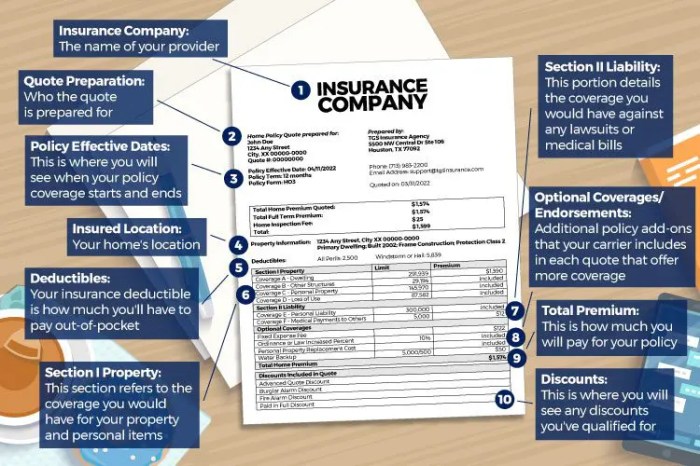

Key Components of a Home Insurance Quote

Understanding the details within a home insurance quote is crucial for securing the right coverage at the best price. A thorough review ensures you’re protected adequately and aren’t paying more than necessary. Let’s break down the key elements you’ll find in a typical quote.

Coverage Limits and Deductibles

Coverage limits define the maximum amount your insurance company will pay for a covered loss. For example, a dwelling coverage limit of $300,000 means the insurer will pay a maximum of $300,000 to rebuild your home in case of a covered event like a fire. This limit should reflect the current replacement cost of your home, not its market value. Deductibles, on the other hand, represent the amount you’ll pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically leads to a lower premium, while a lower deductible results in a higher premium. For instance, a $1,000 deductible means you’ll pay the first $1,000 of any claim, and your insurance will cover the rest up to your coverage limit. Choosing the right balance between deductible and premium is a key decision in securing affordable and effective insurance.

Premium Payment Options

Home insurance quotes typically Artikel various payment options, including monthly, quarterly, semi-annually, or annually. Paying annually often results in a slight discount, as it simplifies administrative costs for the insurer. Monthly payments offer greater flexibility but may incur a small additional fee. The choice depends on your personal financial planning and preference. For example, an annual premium of $1200 could be broken down into monthly payments of approximately $100, with a potential small surcharge added to each payment. Quarterly or semi-annual payments offer a middle ground between convenience and cost savings.

Policy Terms and Conditions

The policy terms and conditions section details the specifics of your coverage, including what is and isn’t covered, exclusions, and the process for filing a claim. This section is crucial for understanding the extent of your protection. For example, standard policies often exclude flood damage, requiring separate flood insurance. Carefully reviewing these terms is vital to avoid unexpected gaps in your coverage. Understanding the cancellation policy, dispute resolution process, and other legal aspects is equally important.

Interpreting Common Insurance Jargon

Understanding insurance terminology is vital for making informed decisions. Here’s a quick guide to some common terms:

- Actual Cash Value (ACV): The replacement cost of an item minus depreciation.

- Replacement Cost Value (RCV): The cost to replace an item with a new one of like kind and quality.

- Liability Coverage: Protection against financial responsibility for injuries or damages caused to others.

- Peril: An event that could cause a loss, such as fire, wind, or theft.

- Premium: The amount you pay for your insurance coverage.

Factors Affecting Quote Prices

Several key factors significantly influence the price you’ll pay for home insurance. Understanding these factors can help you make informed decisions and potentially secure more favorable rates. This section will explore the major contributors to home insurance quote variations.

Location

Your home’s location is a primary determinant of your insurance premium. Areas prone to natural disasters like hurricanes, earthquakes, wildfires, or floods command higher premiums due to the increased risk insurers face. For example, a home located in a coastal region with a history of hurricanes will typically have a much higher premium than a similar home in an inland area with minimal risk of such events. Similarly, homes situated in high-crime areas might also attract higher premiums because of the elevated risk of theft or vandalism. Insurers meticulously analyze historical claims data for specific geographic locations to assess risk accurately.

Home Value

The value of your home directly impacts your insurance premium. A higher-valued home generally means a higher premium because the insurer’s potential payout in case of damage or loss is greater. The replacement cost of your home, factoring in building materials and construction costs, is a crucial element in determining the premium. For instance, a large, custom-built home will likely require a higher premium than a smaller, standard home, even if both are in the same location.

Credit Score

Surprisingly, your credit score can influence your home insurance premium in many regions. Insurers often use credit-based insurance scores to assess your risk profile. A higher credit score generally indicates greater financial responsibility, leading to lower premiums. Conversely, a lower credit score might suggest a higher risk, resulting in higher premiums. This is because individuals with poor credit history might be perceived as less likely to maintain their property properly or pay their premiums on time. The exact impact varies by state and insurer.

Safety Features

Installing safety features in your home can significantly reduce your insurance premium. Features like security alarms, fire suppression systems (sprinklers), and smoke detectors demonstrate your commitment to risk mitigation. Insurers often offer discounts for homes equipped with such safety measures. For example, a home with a monitored security system and fire sprinklers might receive a discount of 10-20% or more compared to a similar home without these features. This is because these features help minimize the likelihood and severity of potential losses.

Lifestyle Choices

Certain lifestyle choices can also affect your home insurance quote. For instance, if you have a history of filing many claims, insurers may view you as a higher risk and charge higher premiums. Similarly, engaging in high-risk activities at home, such as keeping large quantities of flammable materials or owning aggressive dog breeds, could also influence your premium. The presence of a swimming pool without a proper fence can also lead to higher premiums due to the increased risk of accidents.

Impact of Factors on Quote Prices

| Factor | Low Impact | Medium Impact | High Impact |

|---|---|---|---|

| Location | Rural, low-risk area | Suburban, moderate risk | Urban, high-risk area (flood zone, wildfire zone) |

| Home Value | Small, standard home | Average-sized home | Large, custom-built home |

| Credit Score | Excellent (750+) | Good (650-749) | Fair/Poor (below 650) |

| Safety Features | No safety features | Smoke detectors, basic alarm system | Monitored security system, fire sprinklers |

Wrap-Up

Obtaining and understanding home insurance quotes doesn’t have to be daunting. By carefully considering the factors influencing premiums, comparing quotes from different providers, and thoroughly reviewing policy details, you can secure a policy that offers comprehensive coverage at a competitive price. Remember to ask questions, negotiate, and prioritize understanding your policy’s terms and conditions. This proactive approach will ensure you have the peace of mind knowing your home is adequately protected.

General Inquiries

What is the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after a claim.

How long does it typically take to get a home insurance quote?

This varies depending on the provider and the method used (online vs. agent). Online quotes are often instantaneous, while quotes obtained through agents may take a few days.

Can I get a quote without providing my personal information?

While some online tools offer preliminary estimates, obtaining a detailed and accurate quote usually requires providing personal and property information.

What happens if I don’t understand something in my quote?

Contact the insurance provider directly. They should be happy to explain any confusing aspects of your quote or policy.

How often should I review my home insurance policy?

It’s advisable to review your policy annually, or whenever there are significant changes to your home, belongings, or financial situation.