Securing the right homeowners insurance is crucial, yet navigating the complexities of quotes can feel overwhelming. This guide demystifies the process, providing a clear understanding of the factors influencing your premium, the different coverage options available, and how to compare quotes effectively to find the best fit for your needs and budget. We’ll explore everything from online quote tools to direct agent interaction, empowering you to make informed decisions.

Understanding homeowners insurance quotes isn’t just about finding the cheapest option; it’s about ensuring you have adequate protection for your most valuable asset – your home. This guide will equip you with the knowledge to compare policies apples-to-apples, understand the fine print, and ultimately, secure peace of mind.

Obtaining Homeowners Insurance Quotes

Securing the right homeowners insurance is crucial for protecting your most valuable asset. Understanding the various methods for obtaining quotes and navigating the process efficiently is key to finding the best coverage at a competitive price. This section details how to obtain homeowners insurance quotes, outlining the advantages and disadvantages of different approaches.

Online Quote Methods

Several online platforms simplify the process of obtaining homeowners insurance quotes. Many insurance companies offer online quote tools directly on their websites. These tools typically require you to input basic information about your property and coverage needs. You’ll then receive a preliminary quote almost instantly. Another popular method involves using insurance comparison websites, which allow you to compare quotes from multiple insurers simultaneously.

Insurance Comparison Websites: Benefits and Drawbacks

Using insurance comparison websites offers convenience and efficiency by allowing you to see multiple quotes side-by-side. This facilitates a quick comparison of prices and coverage options. However, these websites may not display every insurer available in your area, and the quotes provided are often preliminary and may require further verification with the individual insurance company. Additionally, the algorithm used by these websites may prioritize certain insurers based on their partnerships, potentially influencing the order of results.

Contacting Insurance Agents Directly

Contacting insurance agents directly offers a more personalized approach. Agents can provide expert advice tailored to your specific needs and help you understand the nuances of different policies. They can also assist with the claims process should you need to file a claim. However, this method can be more time-consuming than using online tools or comparison websites. Direct contact also allows for more detailed discussions about specific coverage options and potential discounts.

A Step-by-Step Guide to Getting Homeowners Insurance Quotes

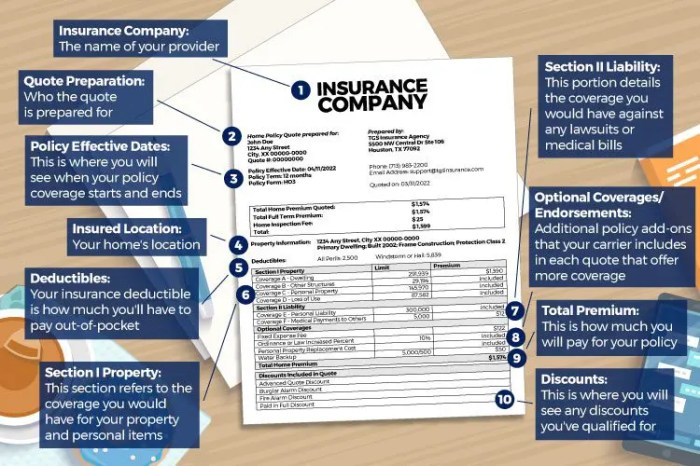

Gathering the necessary information before beginning your quote search streamlines the process. You’ll need details about your property, including its address, square footage, year built, and any recent renovations. Information regarding your coverage preferences, such as desired coverage limits and deductibles, is also essential.

- Gather Property Information: Compile details such as address, square footage, year built, number of bedrooms and bathrooms, type of construction, and any recent renovations or upgrades. Include details about any security systems installed.

- Determine Coverage Needs: Decide on the level of coverage you require for dwelling, personal property, liability, and additional living expenses. Research different coverage options to understand what each entails.

- Use Online Tools: Visit the websites of various insurance companies and use their online quote tools. Input your information accurately and compare the resulting quotes.

- Utilize Comparison Websites: Use insurance comparison websites to gather quotes from multiple insurers simultaneously. Be aware of the limitations mentioned previously.

- Contact Insurance Agents: Reach out to local insurance agents to discuss your needs and obtain personalized quotes. Prepare a list of questions beforehand.

- Review and Compare Quotes: Carefully review all quotes, paying close attention to coverage details, premiums, and deductibles. Don’t solely focus on price; ensure the coverage adequately protects your property.

- Choose a Policy: Select the policy that best meets your needs and budget. Read the policy carefully before signing.

Illustrative Examples

Understanding how different factors influence homeowners insurance quotes is crucial. The following examples illustrate the impact of risk factors on premium costs, showcasing both high- and low-risk scenarios and the effect of varying coverage levels.

High-Risk Home and Quote Impact

Consider a home located in a wildfire-prone area with an older, poorly maintained roof and outdated electrical system. This property is situated near a fault line and has a history of water damage claims. These factors significantly increase the risk of loss for the insurance company. As a result, the insurance quote will likely reflect this elevated risk with significantly higher premiums compared to a low-risk property. The insurer may also impose stricter requirements, such as mandating upgrades to the electrical system or roof before issuing a policy, or may even decline coverage altogether. A potential quote for such a property could easily be double or even triple that of a low-risk equivalent, potentially reaching several thousands of dollars annually.

Low-Risk Home and Corresponding Quote

Conversely, a newly constructed home in a safe neighborhood with modern safety features and a well-maintained structure represents a low-risk profile. The home is equipped with a state-of-the-art security system, smoke detectors, and a sprinkler system. It is situated far from any significant natural disaster zones. This low-risk profile translates to a significantly lower insurance premium. For example, a similar-sized home to the high-risk example, but with the characteristics described above, might receive an annual premium of around $1,000 to $1,500 depending on the coverage level selected. This represents a substantial difference compared to the high-risk scenario.

Impact of Different Coverage Levels on Premiums

Imagine three coverage levels: Basic, Comprehensive, and Premium. A visual representation would show a bar graph. The Basic coverage bar would be the shortest, representing the lowest premium. The Comprehensive coverage bar would be taller, reflecting a higher premium due to broader coverage. Finally, the Premium coverage bar would be the tallest, indicating the highest premium due to extensive coverage including additional features like higher liability limits and replacement cost coverage. The difference in height between each bar visually demonstrates how increased coverage leads to higher premiums. For instance, the basic level might cover only the structure and liability, while the premium level could include additional coverage for personal belongings, additional living expenses, and higher liability limits. The premium cost difference could be significant, possibly ranging from a few hundred to a thousand dollars annually depending on the coverage chosen and the value of the home.

Ultimate Conclusion

Ultimately, obtaining the best homeowners insurance quote involves a blend of online research, direct engagement with insurance professionals, and a thorough understanding of your own coverage needs. By carefully comparing quotes, analyzing policy details, and understanding the factors that influence pricing, you can confidently choose a policy that provides comprehensive protection without breaking the bank. Remember, securing the right coverage is an investment in your future, providing financial security and peace of mind.

Helpful Answers

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

How often can I get a new quote?

You can obtain new quotes as often as needed, especially if your circumstances change (e.g., home improvements, changes in credit score).

What if I have a claim? How will it affect future quotes?

Filing a claim will likely increase your premiums in subsequent years. The extent of the increase depends on the claim’s nature and cost.

Can I bundle my homeowners and auto insurance?

Yes, many insurers offer discounts for bundling multiple policies.

What documents do I need to get a quote?

Typically, you’ll need your address, property details (square footage, year built), and details about your current coverage (if any).