Securing affordable and comprehensive home insurance is a crucial step in protecting your most valuable asset. This guide delves into the intricacies of obtaining a Progressive home insurance quote, exploring the factors that influence pricing, the online quote process, and the overall customer experience. We’ll compare Progressive’s approach to competitors and offer insights to help you navigate this important financial decision.

From understanding the components of a typical quote to analyzing the accuracy of online estimations and exploring post-quote engagement strategies, we aim to provide a clear and informative overview. We’ll also examine Progressive’s customer base, highlighting the needs and preferences of those seeking home insurance through this provider. This comprehensive analysis will equip you with the knowledge necessary to make informed choices regarding your home insurance needs.

Analyzing the Online Quote Process

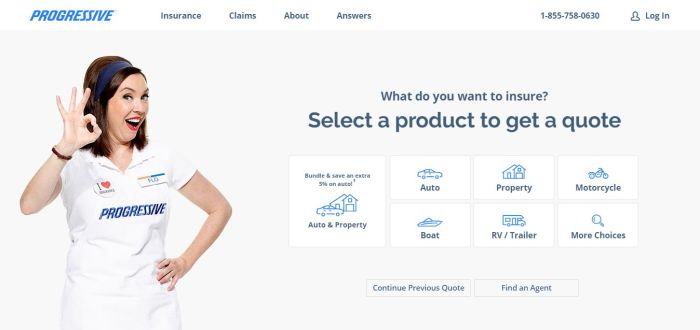

Obtaining a home insurance quote from Progressive online is a straightforward process designed for ease of use. The entire process, from initial information input to receiving a quote, is typically completed within a few minutes, depending on the complexity of the property and the user’s input speed. The steps are intuitive and guided, minimizing the potential for confusion or errors.

The steps involved in obtaining a Progressive home insurance quote online involve providing key information about the property and the policyholder. This information is used to generate a personalized quote based on risk assessment models. Accuracy in providing this information is crucial for receiving an accurate quote.

Steps in Obtaining an Online Home Insurance Quote

The online quote process generally follows these steps: First, the user navigates to the Progressive website or opens the mobile app. Then, they initiate the quote process, typically by clicking a button or selecting a relevant option. Next, they are prompted to provide essential information about their home, such as its address, square footage, year built, and the number of bedrooms and bathrooms. Following this, information about the homeowner, including their contact details, is required. Finally, after reviewing the information provided, the user submits the request, and Progressive generates a personalized quote.

User Flow Diagram of the Online Quote Process

Imagine a flowchart. The first box would be “Navigate to Progressive Website/App”. This leads to a second box, “Initiate Quote Request”. The next several boxes represent the data input stages: “Enter Home Address”, “Enter Home Details (sq ft, year built, etc.)”, “Enter Homeowner Details (name, contact info)”, “Select Coverage Options (optional)”. From these, a box labeled “Submit Request” leads to the final box, “Receive Quote”. This diagram visually represents the linear progression of the online quote process, highlighting the sequential nature of data input and quote generation.

User Experience of the Progressive Online Quote Process

Progressive aims for a user-friendly experience. The website and app are generally considered intuitive and easy to navigate. Clear instructions and prompts guide users through each step. The forms are designed to be concise, avoiding unnecessary complexity. However, user experience can vary based on individual technological proficiency and internet speed. Some users might find the process slightly lengthy if their property details are complex or if they require additional coverage options. The overall design prioritizes a clear and efficient path to obtaining a quote, minimizing friction and maximizing user satisfaction. Real-time feedback and error messages also help guide users toward accurate input, improving the overall experience.

Visual Representation of Quote Data

Understanding the factors influencing your home insurance quote and comparing different coverage options is crucial for making an informed decision. Visual representations can significantly aid this process, making complex data more accessible and understandable. We will explore two key visuals to illustrate this.

Impact of Factors on Quote Price

A bar chart effectively illustrates how different factors influence the final quote. The horizontal axis would list the key factors, such as home location, square footage, age of the home, security systems installed (presence of alarm systems, security cameras), and claims history. The vertical axis would represent the percentage increase or decrease in the quote relative to a baseline premium. For example, a bar for “Home Location (High-Risk Area)” might show a 20% increase, while “Security System (Alarm System)” could depict a 10% decrease. This allows for easy comparison of the relative impact of each factor. Each bar could be color-coded for better visual distinction, such as using shades of green for positive impacts (reductions) and shades of red for negative impacts (increases).

Comparison of Premium Costs Across Coverage Levels

A clustered column chart is ideal for comparing premium costs across various coverage levels. The horizontal axis would list the different coverage levels (e.g., Basic, Standard, Comprehensive). Each coverage level would have a cluster of columns representing the premium cost for different deductibles (e.g., $500, $1000, $2500). The vertical axis represents the premium cost in dollars. This visual allows for a direct comparison of the cost differences between coverage levels and the impact of selecting different deductible amounts. For instance, one might see that upgrading from Basic to Comprehensive coverage results in a significant increase in premium, but choosing a higher deductible within a specific coverage level can lead to considerable savings. Different colors could be used to represent different deductible amounts within each coverage level for clarity. The chart could also include a legend clearly identifying each color and its corresponding deductible.

Last Word

Obtaining a Progressive home insurance quote is a multi-faceted process influenced by various factors, from your home’s characteristics to your personal risk profile. By understanding these factors and navigating the online quote process effectively, you can secure a policy that offers the right coverage at a competitive price. Remember to compare quotes from different providers to ensure you’re getting the best value for your investment. This guide provides a solid foundation for understanding the complexities of home insurance and empowers you to make informed decisions about protecting your home.

General Inquiries

What factors are NOT considered in the initial online Progressive home insurance quote?

The initial online quote may not fully account for specific details about your home’s construction, location-specific risks (e.g., flood zones), or certain types of coverage add-ons. A final quote will incorporate a more detailed assessment.

Can I get a quote over the phone?

Yes, Progressive offers phone quotes as well as online quotes. Contacting them directly allows for personalized assistance and clarification of any questions.

What happens if I find a lower quote elsewhere after receiving a Progressive quote?

Progressive encourages comparison shopping. If you find a lower quote with comparable coverage from another reputable insurer, you can use this information to negotiate a better rate with Progressive or choose the more favorable offer.

How long is a Progressive home insurance quote valid for?

The validity period varies; it’s best to check the specific timeframe provided on your quote. Rates can change based on market conditions and underwriting factors.