Owning a home is a significant achievement, a testament to hard work and financial stability. But with this achievement comes responsibility, and a crucial aspect of homeownership is securing adequate protection. This guide delves into the intricacies of home insurance policies, providing a clear and accessible understanding of coverage, costs, and claims processes. We’ll unravel the complexities, demystifying the jargon and empowering you to make informed decisions about protecting your most valuable asset.

From understanding the basics of different policy types to navigating the claims process and making informed choices about coverage levels, this comprehensive guide serves as your roadmap to securing the right home insurance policy. We’ll explore the factors influencing premiums, common misconceptions, and preventative measures you can take to minimize risks. Ultimately, our goal is to equip you with the knowledge necessary to confidently protect your home and your financial future.

Understanding Home Insurance Policy Basics

A home insurance policy is a crucial financial safety net, protecting your most valuable asset – your home – from unforeseen events. Understanding the key components of your policy is essential to ensure you have adequate coverage and avoid costly surprises. This section will Artikel the fundamental elements of a standard home insurance policy, clarifying the types of coverage, common exclusions, and differences between various policy types.

Fundamental Components of a Home Insurance Policy

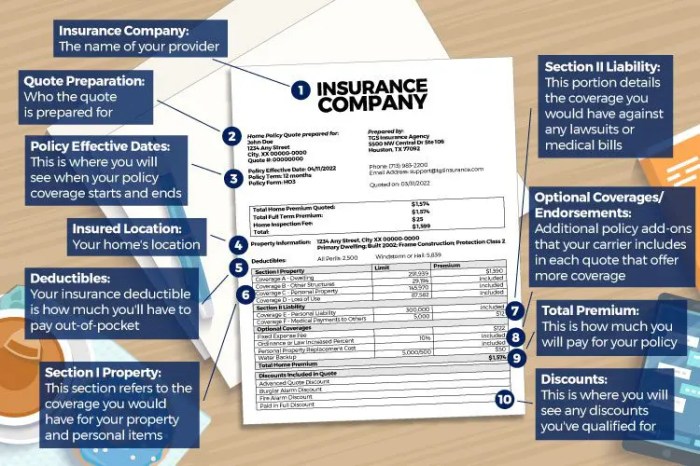

A standard homeowners insurance policy typically consists of two main parts: coverage for the dwelling itself and coverage for personal property. Dwelling coverage protects the physical structure of your home, including attached structures like garages and sheds, against damage from covered perils. Personal property coverage protects your belongings inside and, in some cases, outside your home. Liability coverage is also a key component, protecting you financially if someone is injured on your property or if you accidentally damage someone else’s property. Finally, additional living expenses (ALE) coverage helps pay for temporary housing and other expenses if your home becomes uninhabitable due to a covered loss.

Types of Coverage Included

Home insurance policies offer various types of coverage, each addressing specific risks. These commonly include coverage for fire, windstorms, hail, vandalism, theft, and liability. Some policies may also include coverage for specific perils such as earthquakes or floods, although these are often purchased as separate endorsements due to their higher risk profiles. The specific perils covered will vary depending on the policy and location. For example, a policy in a hurricane-prone area will likely offer more comprehensive windstorm coverage than a policy in a less exposed region.

Common Exclusions and Limitations

It’s crucial to understand what your home insurance policy *doesn’t* cover. Common exclusions include damage caused by normal wear and tear, neglect, or intentional acts. Many policies also exclude damage from specific events like floods, earthquakes, and acts of war. Furthermore, there are usually limitations on the amount of coverage provided for certain items, such as jewelry or valuable artwork. These limitations often necessitate the purchase of separate riders or endorsements for increased coverage. For example, a standard policy might only cover a limited amount for jewelry loss, requiring a separate floater policy for more comprehensive coverage of expensive pieces.

Comparison of Home Insurance Policy Types

Different types of homeowner’s insurance policies cater to various needs and situations. The most common types are HO-3, HO-4, and HO-6. Below is a comparison table highlighting their key differences:

| Policy Type | Coverage | Suitable for | Key Differences |

|---|---|---|---|

| HO-3 (Special Form) | Open perils on dwelling, named perils on personal property | Homeowners | Broadest coverage for dwelling; named perils for personal property. |

| HO-4 (Renters Insurance) | Named perils on personal property, liability coverage | Renters | Covers personal belongings and liability; does not cover the structure itself. |

| HO-6 (Condominium Insurance) | Named perils on personal property, liability coverage, limited dwelling coverage | Condominium Owners | Covers personal belongings and liability; covers the interior of the condo unit, but typically excludes the building’s exterior. |

Factors Affecting Policy Costs

Understanding the factors that influence your home insurance premiums is crucial for securing the best possible coverage at a price you can afford. Several key elements contribute to the final cost, and being aware of these can help you make informed decisions about your policy.

Location’s Impact on Insurance Rates

Your home’s location significantly impacts your insurance premium. Insurers assess risk based on factors such as crime rates, the frequency of natural disasters (like hurricanes, earthquakes, or wildfires), and the proximity to fire hydrants or other emergency services. For example, a home situated in a high-risk wildfire zone will generally command a higher premium than a similar home in a low-risk area. Similarly, coastal properties are often subject to higher premiums due to the increased risk of storm damage. Urban areas with high crime rates may also result in increased premiums compared to quieter, more rural locations. The insurer’s risk assessment model considers historical data for each area to determine the likelihood of claims.

Age and Condition of the Home

The age and condition of your home directly influence the cost of your insurance. Older homes, particularly those lacking modern safety features (like updated electrical systems or plumbing), are considered higher risk due to increased potential for damage or failure. Conversely, newer homes with modern construction and updated safety features typically attract lower premiums. The insurer’s assessment includes a detailed review of the home’s structure, materials used, and the presence of any existing damage or needed repairs. A thorough inspection may be conducted to determine the home’s overall condition and assess potential risks. For example, a home with a poorly maintained roof is more likely to experience damage from storms, resulting in a higher premium.

Coverage Levels and Associated Costs

Different levels of coverage directly affect the cost of your home insurance policy. Basic coverage, often referred to as actual cash value (ACV), covers the replacement cost of your home minus depreciation. This means you will receive less money if you need to replace damaged property. Broader coverage options, such as replacement cost coverage, pay for the full cost of repairing or replacing your home regardless of depreciation. Comprehensive policies offering additional coverage for things like liability and personal possessions will naturally be more expensive than basic policies. The increased coverage provides greater financial protection but comes at a higher premium. Choosing the appropriate level of coverage requires a careful balance between affordability and the level of protection you need. A comparison of quotes from different insurers with varying coverage levels will help you make an informed decision.

Common Misconceptions about Home Insurance

Many people hold incorrect assumptions about their home insurance policies, leading to inadequate coverage or unexpected financial burdens. Understanding the reality behind these misconceptions is crucial for securing proper protection. This section clarifies three common misunderstandings and their potential consequences.

Home Insurance Covers Everything

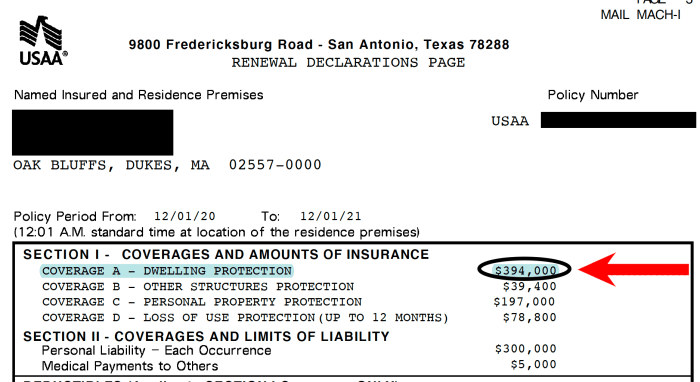

This is a pervasive misconception. Home insurance policies typically cover damage from specific perils, such as fire, windstorms, and theft. However, they often exclude damage caused by other events, like floods, earthquakes, or wear and tear. A comprehensive policy might include these additional perils, but they usually require separate endorsements and increased premiums. It’s essential to carefully review your policy’s declaration page and the detailed description of coverage to understand exactly what is and isn’t included.

Replacing Personal Belongings is Simple

Many assume that replacing their belongings after a covered loss is straightforward. In reality, accurately assessing the value of personal possessions and providing sufficient proof of ownership can be surprisingly challenging. Insurance companies require detailed inventories, receipts, or photographic evidence to substantiate claims. Failing to maintain a comprehensive home inventory can significantly delay or reduce the payout received. For example, imagine a fire destroying a family’s belongings. Without a detailed inventory, they might struggle to prove the value of their lost items, resulting in a significantly lower settlement than the actual replacement cost. This could leave them facing considerable financial strain.

Increased Deductible Always Means Lower Premiums

While raising your deductible generally lowers your premium, it’s crucial to consider the financial implications. A higher deductible means you’ll pay more out-of-pocket if you make a claim. It’s essential to find a balance between affordability and your ability to manage a significant upfront expense in the event of a claim. For instance, a homeowner might opt for a higher deductible to save on premiums, but if they experience a minor incident that costs less than their deductible, they wouldn’t receive any insurance payout, making the premium savings pointless. Therefore, a thorough cost-benefit analysis is necessary before making this decision.

Last Recap

Securing a home insurance policy is more than just a financial transaction; it’s about safeguarding your peace of mind. By understanding the nuances of coverage, costs, and claims procedures, you can navigate the process with confidence. Remember to compare quotes, consider preventative measures, and don’t hesitate to ask questions. This guide provides a solid foundation for making informed decisions about protecting your most valuable investment – your home. Proactive planning and a thorough understanding of your policy are key to ensuring you have the right protection in place.

Question Bank

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV considers depreciation when determining the payout for damaged or lost items, while replacement cost coverage pays for the full cost of replacing the item without considering depreciation.

What are some common exclusions in a home insurance policy?

Common exclusions include flood damage, earthquake damage, and intentional acts. Specific exclusions vary by policy and insurer.

How often should I review my home insurance policy?

It’s advisable to review your policy annually, or whenever there are significant changes to your home or possessions (e.g., renovations, valuable purchases).

Can I increase my coverage mid-term?

Yes, you can usually increase your coverage mid-term, but this will likely result in a premium adjustment.

What should I do if my claim is denied?

If your claim is denied, carefully review the denial reason. You may be able to appeal the decision or seek legal counsel.