Finding the right insurance coverage can feel overwhelming. Juggling car and home insurance needs often leads to separate searches, comparisons, and policies. But what if there was a simpler, potentially more cost-effective solution? This guide explores the world of bundled car and home insurance quotes, examining the benefits, drawbacks, and the process of securing the best coverage for your needs.

We’ll delve into the competitive landscape, comparing major providers and their bundled offerings. Learn how to navigate the quote comparison process, understand policy details, and ultimately choose the best fit for your budget and lifestyle. We’ll also address common concerns and provide practical tips to make the process smooth and efficient.

Understanding the Search Intent

Understanding the motivations behind a user searching for “car and home insurance quote” is crucial for crafting effective marketing and providing a seamless customer experience. The search query itself reveals a user actively seeking information to compare prices and potentially purchase insurance policies. However, the underlying needs and intentions can be quite diverse.

The search for “car and home insurance quote” reflects a user at various stages of their customer journey, ranging from initial research and comparison shopping to a near-final decision. Understanding these stages allows for targeted messaging and optimized service delivery.

User Needs Behind the Search

Users searching for “car and home insurance quote” exhibit diverse needs. Some may be new homeowners or car owners, initiating their insurance journey. Others might be existing policyholders seeking better rates or more comprehensive coverage. Still others may be looking to bundle their home and auto insurance for potential cost savings. This diverse set of needs requires a flexible approach to information presentation and service delivery. For instance, a first-time homeowner will need more basic information about coverage options, while an experienced policyholder may focus primarily on price comparison and policy details.

Stages of the Customer Journey

The search represents several potential stages in the customer journey. The awareness stage involves initial research, comparing different insurance providers and their offerings. The consideration stage focuses on evaluating specific quotes, comparing features and prices. Finally, the decision stage involves selecting a policy and completing the purchase. A well-structured website and targeted advertising can support users at each stage. For example, the awareness stage might be addressed with informative blog posts comparing insurance types, while the decision stage would benefit from a clear, user-friendly quote comparison tool and online purchase options.

Motivations Driving the Search

The primary motivations behind this search frequently include cost savings, convenience, and the appeal of bundled offers. Many users seek the lowest possible premium, driving them to compare quotes from multiple insurers. Convenience is also a significant factor; online quote tools and streamlined application processes are highly valued. The possibility of bundling home and auto insurance for a discounted rate is a strong incentive for many, offering both financial and administrative benefits. For example, a user might find a bundled package 15% cheaper than purchasing separate policies, a significant saving that motivates them to explore this option.

Visual Representation of Information

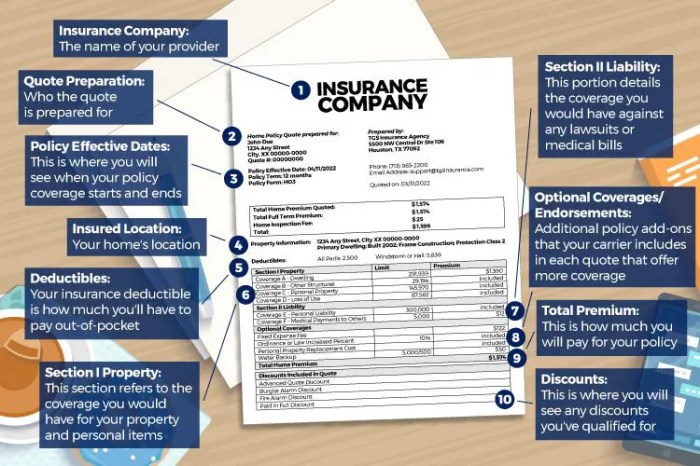

A compelling visual representation can significantly improve understanding and engagement when comparing insurance costs. An infographic, specifically designed to highlight the potential savings of bundled car and home insurance, would be highly effective. This would present complex financial information in a clear, concise, and easily digestible format.

An infographic illustrating the cost savings of bundled policies would use a clear and visually appealing design to communicate the financial advantages to potential customers.

Infographic Design and Data

The infographic would compare the total annual cost of separate car and home insurance policies against the cost of a bundled policy. Data selection would involve obtaining average premiums for both scenarios from reputable insurance providers in a specific geographic area (e.g., national averages or averages for a major city). This data should be clearly sourced and referenced within the infographic. The design would employ a consistent color scheme and font to maintain visual harmony. We’d use a bar graph to visually represent the difference in annual premiums. The bar representing the bundled policy cost would be significantly shorter than the combined height of the bars representing separate car and home insurance costs, visually demonstrating the savings. The difference in cost would be clearly labeled and expressed as both a dollar amount and a percentage.

Visual Elements and Message

The infographic would feature two main sections: one illustrating the cost of separate policies and another showing the cost of a bundled policy. Each section would include a clear title and relevant data presented in a bar graph format. A key would explain the meaning of each bar. A prominent call to action, such as “Get a Free Quote Today,” would be included to encourage engagement. Supporting text would explain the benefits of bundling, such as convenience and potential discounts. The overall message is simple: Bundling saves you money and simplifies your insurance needs. The visual elements, including icons representing cars and homes, would enhance the clarity and appeal of the infographic. To further illustrate the savings, a simple calculation could be shown demonstrating the total savings over a five-year period, further reinforcing the long-term financial benefits of bundling. For example, a scenario could show that separate policies cost $2,000 annually, while a bundled policy costs $1,600, resulting in a $400 annual saving and $2,000 over five years. This example is illustrative and should be replaced with actual data for a specific location.

Final Wrap-Up

Securing comprehensive car and home insurance doesn’t have to be a daunting task. By understanding your needs, comparing quotes effectively, and carefully considering the advantages and disadvantages of bundled policies, you can confidently choose the coverage that best protects your assets and provides peace of mind. Remember to prioritize your individual circumstances and thoroughly review policy details before making a final decision. Take control of your insurance needs today and find the perfect balance of protection and affordability.

FAQ Explained

What is a bundled car and home insurance policy?

A bundled policy combines your car and home insurance coverage under a single provider, often resulting in discounts.

How much can I save by bundling?

Savings vary depending on the provider and your individual circumstances. It’s best to compare quotes to see potential savings.

Can I bundle with any provider?

Not all providers offer bundled policies. Check with your preferred providers to see if this option is available.

What happens if I make a claim on one part of the bundled policy?

This depends on your provider’s policy. Some may increase your premiums, while others may not. Review the policy details carefully.

Can I customize coverage in a bundled policy?

Typically, you can customize coverage options to a certain extent, but the flexibility might be less compared to separate policies. Check individual provider offerings.