Unexpected home repairs can strike at any time, transforming a peaceful evening into a financial headache. Home warranty insurance, often misunderstood, acts as a crucial safety net, mitigating the cost of these unforeseen breakdowns. This guide delves into the intricacies of home warranty insurance, clarifying its benefits, limitations, and the crucial steps involved in choosing the right plan.

We will explore the key differences between home warranty insurance and standard homeowner’s insurance, examining the types of appliances and systems typically covered. Furthermore, we’ll navigate the process of filing a claim, comparing various providers and highlighting essential features to consider. Ultimately, this guide empowers you to make informed decisions, ensuring peace of mind in protecting your most valuable asset: your home.

Defining Home Warranty Insurance

Home warranty insurance is a service contract that protects homeowners from the high cost of repairing or replacing major home systems and appliances. Unlike homeowner’s insurance, which covers damage caused by unforeseen events like fire or theft, a home warranty covers the breakdown of specific items due to normal wear and tear. It essentially provides peace of mind by offering a safety net against unexpected repair bills.

Home Warranty Insurance versus Homeowner’s Insurance

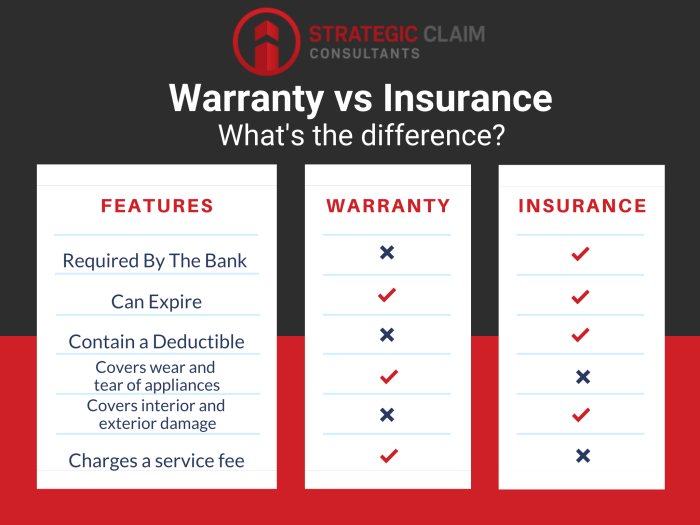

Home warranty insurance and homeowner’s insurance serve distinct purposes. Homeowner’s insurance is a legally mandated requirement in most mortgage situations, providing financial protection against property damage or loss from covered perils such as fire, windstorms, and theft. It typically covers the structure of your home and its contents, but not the appliances or systems themselves unless damage results from a covered peril. In contrast, a home warranty covers the repair or replacement of specific home systems and appliances due to malfunctions resulting from normal wear and tear, regardless of the cause. Think of it this way: homeowner’s insurance protects against sudden, catastrophic events, while a home warranty safeguards against the gradual deterioration of home components.

Covered Appliances and Systems

Home warranty plans typically cover a range of major home systems and appliances. Commonly covered items include heating and air conditioning systems (HVAC), plumbing systems (including water heaters), electrical systems, refrigerators, ovens, dishwashers, washing machines, and dryers. The specific items covered will vary depending on the plan you choose. Some plans may also include coverage for additional items such as garbage disposals, built-in microwaves, and even pool pumps. It’s crucial to carefully review the contract’s terms and conditions to understand precisely what is and is not covered.

Comparison of Typical Home Warranty Plans

A clear understanding of different plans is crucial before purchasing. The following table compares typical home warranty plans available, highlighting key differences in coverage, cost, and limitations. Note that these are examples and actual plans and pricing will vary depending on location, provider, and chosen coverage levels.

| Plan Name | Coverage Details | Cost | Limitations |

|---|---|---|---|

| Basic Plan | Covers major appliances (refrigerator, oven, dishwasher, etc.) and some basic plumbing and electrical systems. | $300 – $400 per year | Limited coverage for specific systems; may exclude certain appliances or parts; service call fees may apply. |

| Comprehensive Plan | Includes coverage for major appliances, HVAC systems, plumbing systems, electrical systems, and potentially additional items like pool pumps or water softeners. | $500 – $700 per year | Higher deductible; may have limitations on the number of service calls per year; certain repairs or replacements may be excluded. |

| Luxury Plan | Covers a wider range of appliances and systems, often including more expensive items and offering higher coverage limits. | $700 – $1000+ per year | Higher deductible; typically has a higher annual fee; may still have some exclusions and limitations on certain repairs. |

| System Specific Plan | Focuses on a specific system, such as HVAC or plumbing. | $200 – $500 per year | Only covers the specified system; additional coverage for other systems would require a separate plan. |

Coverage and Exclusions

Home warranty insurance provides coverage for the repair or replacement of major home systems and appliances, offering peace of mind to homeowners. However, understanding the nuances of coverage and exclusions is crucial for making an informed decision. This section will detail common exclusions, factors influencing cost, the claims process, and beneficial scenarios.

Common Exclusions in Home Warranty Contracts

Home warranty contracts typically exclude certain items and situations. These exclusions often vary between providers and specific policy types, so careful review of the contract is essential. Common exclusions frequently include pre-existing conditions (damage already present before the contract started), damage caused by neglect or misuse, and normal wear and tear. Furthermore, many policies exclude cosmetic issues, pest infestations, and damage from natural disasters (unless specifically added as supplemental coverage). Some policies also limit coverage for certain appliances based on age or condition. For example, a refrigerator older than a specified number of years might only be covered for specific parts, not a full replacement.

Factors Influencing the Cost of Home Warranty Insurance

Several factors influence the cost of a home warranty. The size of the home, the age of the home’s systems and appliances, the coverage level selected (basic, comprehensive, or premium), and the location of the property all play a role. Homes in areas prone to natural disasters, for instance, may have higher premiums due to increased risk. The provider’s reputation and the specific features included in the policy also impact the overall price. A policy with broader coverage and more comprehensive services will generally be more expensive than a basic plan covering only essential systems. For example, a policy covering a wider range of appliances, including a washing machine and dryer, might be more costly than a plan that only covers the heating and cooling systems.

The Process of Filing a Claim

Filing a claim typically involves contacting the home warranty provider’s designated customer service line. The homeowner will usually need to provide details about the issue, including the affected appliance or system and a description of the problem. The provider may then dispatch a qualified technician to assess the situation. If the damage is covered under the policy, the repair or replacement will be authorized, subject to the terms and conditions of the contract. There might be a service fee payable by the homeowner for each service call, even if the repair is covered. This fee varies depending on the provider and the specific policy. For instance, a service call fee might be $75 for a simple repair, but could be higher for more complex issues.

Situations Where a Home Warranty is Beneficial

A home warranty can be particularly beneficial for homeowners who are new to homeownership, lack significant savings for unexpected repairs, or own older homes with aging systems. For example, a homeowner with a 20-year-old air conditioning unit might find the peace of mind provided by a home warranty valuable, knowing that a potential costly repair or replacement would be covered. Similarly, a first-time homeowner might appreciate the protection against unexpected breakdowns of major appliances, preventing a significant financial burden. It can also be advantageous for those renting out properties, as it protects against the high costs of unexpected repairs to rental units.

Benefits and Drawbacks

Home warranty insurance offers a compelling value proposition for homeowners, but like any insurance product, it comes with both advantages and disadvantages. Understanding these aspects is crucial before deciding whether a home warranty is the right choice for your specific circumstances. This section will explore the key benefits and drawbacks to help you make an informed decision.

Advantages of Home Warranty Insurance

A home warranty can provide significant peace of mind by offering financial protection against unexpected repair costs for major home systems and appliances. The cost of repairing or replacing a malfunctioning air conditioner, water heater, or refrigerator can quickly reach thousands of dollars. A home warranty helps mitigate this risk by covering the cost of repairs or replacements, often for a fraction of the overall expense. This predictable cost can be particularly beneficial for homeowners on a fixed budget or those concerned about unforeseen financial burdens. Furthermore, the convenience of having a pre-arranged service network can streamline the repair process, saving you time and hassle in a stressful situation. Instead of searching for and vetting contractors yourself, you can rely on the warranty company’s network of pre-approved professionals.

Disadvantages and Limitations of Home Warranty Coverage

While home warranties offer substantial benefits, it’s essential to understand their limitations. Coverage often excludes pre-existing conditions, meaning problems present before the warranty was purchased are typically not covered. Additionally, warranties frequently have service call fees, deductibles, and limitations on the number of repairs per year for each covered item. These costs can add up, potentially negating some of the perceived savings. The quality of service provided by the warranty company’s network of contractors can also vary, and some homeowners have reported delays or dissatisfaction with the repair work. Finally, the fine print of a home warranty contract is often complex, and it’s crucial to read it thoroughly before signing to understand the exact scope of coverage and any exclusions.

Value Proposition for Different Homeowner Profiles

The value of a home warranty differs significantly depending on the homeowner’s circumstances. For instance, older homes with aging appliances and systems might benefit greatly from the protection a home warranty provides, as the likelihood of costly repairs increases with age. Homeowners on a tight budget might also find the predictable monthly payments more manageable than the unpredictable expense of major home repairs. Conversely, homeowners with newer homes and substantial savings might find a home warranty less necessary, as the risk of major repairs is lower, and they can more easily absorb the cost if a problem arises. Similarly, homeowners who are comfortable performing basic home maintenance themselves might find the cost of a warranty outweighs the benefits.

Pros and Cons Summary

Before purchasing a home warranty, carefully weigh the following:

- Pros: Predictable monthly payments; protection against costly repairs; convenience of a pre-arranged service network; potential cost savings on major repairs.

- Cons: Exclusions and limitations in coverage; service call fees and deductibles; potential variations in contractor quality; complex contract terms; may not be cost-effective for all homeowners.

Last Recap

Securing the right home warranty insurance is a proactive step towards safeguarding your home and finances. By understanding the nuances of coverage, comparing providers, and knowing your rights as a consumer, you can navigate the complexities of homeownership with greater confidence. Remember, a well-chosen home warranty can offer significant financial protection against the unexpected, transforming potential stress into manageable situations. Take the time to research and choose a plan that best fits your specific needs and budget.

Questions and Answers

What is the difference between a home warranty and homeowner’s insurance?

Homeowner’s insurance covers damage to the structure of your home and liability, while a home warranty covers the repair or replacement of specific appliances and systems. They are distinct but complementary.

Are pre-existing conditions covered by a home warranty?

Generally, no. Most home warranties exclude pre-existing conditions known to the homeowner before the policy begins. It’s crucial to disclose any known issues during the application process.

How long does it typically take to resolve a claim?

The timeframe varies by provider and the complexity of the repair, but many aim for resolution within a few days to a couple of weeks.

Can I choose my own repair contractor?

Most home warranty companies use a network of pre-approved contractors. While some may offer flexibility, it’s essential to check the specific terms of your contract.