Securing your family’s future through life insurance is a significant decision, and understanding the costs involved is crucial. This guide delves into the intricacies of 30-year term life insurance rates, examining how age, health, and lifestyle factors influence premiums. We’ll explore the various aspects of obtaining and comparing quotes, ensuring you’re well-equipped to make an informed choice.

We’ll cover key factors like age, health status, and lifestyle choices, demonstrating how these elements impact the cost of your policy. Understanding these variables allows for a more accurate assessment of your insurance needs and empowers you to find the most suitable and cost-effective plan.

Understanding 30-Year Term Life Insurance

A 30-year term life insurance policy provides a death benefit for a fixed period of 30 years. This type of policy is a straightforward and often cost-effective way to secure financial protection for your loved ones during a specific timeframe. Understanding its characteristics and comparing it to other options is crucial for making an informed decision.

Characteristics of 30-Year Term Life Insurance

30-year term life insurance offers a level death benefit for the entire 30-year term. Premiums are typically fixed for the duration of the policy, making budgeting easier. Upon the policy’s expiration, coverage ends unless renewed (often at a significantly higher rate). The policy’s simplicity is a key advantage, focusing solely on providing a death benefit during the specified term. It does not accumulate cash value like some other types of life insurance.

Benefits and Drawbacks of a 30-Year Term

The primary benefit is the affordability of the premiums, especially for younger individuals. This allows for greater coverage at a lower cost compared to permanent life insurance options. The fixed premium offers financial predictability. However, a significant drawback is the coverage ending after 30 years. If you still need coverage after that time, you’ll need to renew (likely at a higher cost) or purchase a new policy. The lack of cash value accumulation is another consideration.

Comparison with Other Life Insurance Types

Unlike 30-year term life insurance, whole life insurance and universal life insurance offer lifelong coverage and cash value accumulation. Whole life policies have fixed premiums and a guaranteed death benefit, while universal life policies offer more flexibility in premium payments and death benefit amounts. However, these permanent policies typically have significantly higher premiums than term life insurance. Choosing between them depends on individual financial goals and risk tolerance. For example, someone focused on providing coverage for mortgage payments might find a 30-year term policy sufficient, whereas someone aiming for long-term wealth building might prefer a whole life policy.

Suitable Situations for a 30-Year Term

A 30-year term policy is often suitable for individuals with specific, time-limited financial obligations, such as mortgage payments or children’s education expenses. Young families seeking affordable coverage during their children’s formative years frequently choose this option. Individuals with a clear understanding that their financial needs will diminish after 30 years might also find this type of policy appropriate. For example, a couple planning to pay off their mortgage within 30 years might find this type of coverage sufficient.

Policy Types Compared

| Policy Length | Premium Payment Period | Death Benefit | Typical Use Case |

|---|---|---|---|

| 30 Years | 30 Years | Fixed, level amount | Mortgage protection, family coverage during child-rearing years |

| Whole Life | Lifetime | Fixed, or increasing, amount | Estate planning, long-term financial security |

| Universal Life | Flexible | Variable, adjustable amount | Flexibility in premium payments and coverage amounts |

Factors Affecting 30-Year Term Life Insurance Rates

Several key factors influence the cost of a 30-year term life insurance policy. Understanding these factors allows individuals to make informed decisions and potentially secure more favorable rates. These factors interact in complex ways, and your individual circumstances will determine your final premium.

Age

Age is a significant determinant of life insurance premiums. Statistically, the older a person is, the higher their risk of death within the policy term. Therefore, insurers charge higher premiums to older applicants to reflect this increased risk. For example, a 30-year-old applying for a 30-year term policy will generally pay a significantly lower premium than a 45-year-old applying for the same coverage. This difference reflects the increased probability of a claim being filed within the 30-year period for the older applicant. The premium increases steadily with age, reflecting the escalating risk profile.

Health Status

An applicant’s health status plays a crucial role in determining their insurance rates. Individuals with pre-existing conditions or a history of health issues, such as heart disease, diabetes, or cancer, will typically face higher premiums. Insurers assess the applicant’s medical history through a thorough application process, which may include medical examinations and questionnaires. Those with excellent health and no significant medical history generally qualify for the lowest rates. Conversely, individuals with serious health problems may be denied coverage altogether or offered coverage with substantially higher premiums or limitations.

Smoking Status

Smokers consistently pay significantly higher premiums than non-smokers. This is because smoking significantly increases the risk of various life-threatening illnesses, including lung cancer, heart disease, and respiratory problems. Insurers recognize this elevated risk and adjust premiums accordingly. The difference in rates between smokers and non-smokers can be substantial, often amounting to hundreds or even thousands of dollars annually. Quitting smoking can lead to lower premiums in the future, sometimes after a period of abstinence.

Lifestyle Choices

Various lifestyle choices influence insurance premiums. Beyond smoking, factors like excessive alcohol consumption, dangerous hobbies (e.g., skydiving), and a lack of regular exercise can all increase an individual’s risk profile. Insurers assess these factors during the underwriting process. For instance, someone who regularly participates in extreme sports might face higher premiums due to the increased risk of injury or death. Maintaining a healthy lifestyle, including regular exercise, a balanced diet, and responsible alcohol consumption, can positively influence your premiums. A healthy lifestyle contributes to longevity and reduces the likelihood of health issues, ultimately impacting your insurance cost favorably.

Rate Variations by Age

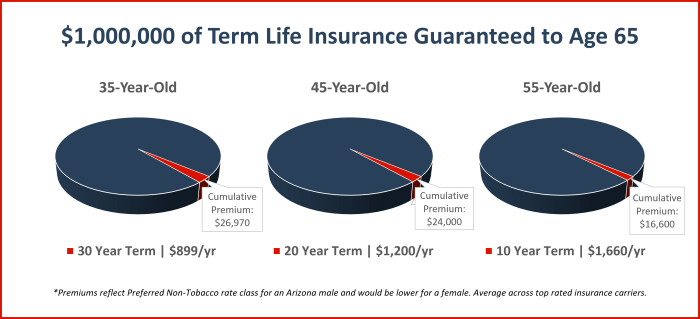

Understanding how age impacts 30-year term life insurance rates is crucial for making informed decisions. Premiums are significantly influenced by the applicant’s age, reflecting the increased risk associated with older age groups. This section will explore this relationship in detail.

The cost of 30-year term life insurance increases as you get older. This is because statistically, the older you are, the higher your risk of death within the 30-year policy term. Insurance companies base their premiums on actuarial tables that reflect these mortality risks.

Illustrative Rate Data

The following bullet points provide a simplified example of how rates might vary across different age groups. Note that these are illustrative figures and actual rates will vary depending on numerous factors including health, lifestyle, and the specific insurance company.

- Age 25-35: Annual premium for $500,000 coverage might range from $20 to $35 per month.

- Age 35-45: Annual premium for the same coverage could increase to $40 to $70 per month.

- Age 45-55: The annual premium for $500,000 coverage might rise to $80 to $150 per month or more.

Visual Representation of Age and Premium Cost

A line graph would effectively illustrate the relationship between age and premium cost. The horizontal axis (x-axis) would represent age, ranging from, for example, 25 to 55, broken down into five-year intervals. The vertical axis (y-axis) would represent the monthly premium cost. The graph would show a steadily increasing line, demonstrating the upward trend in premiums as age increases. The steeper the slope of the line at any point, the faster the rate of premium increase at that age range. Different colored lines could represent different coverage amounts to show how the premium increases with both age and coverage.

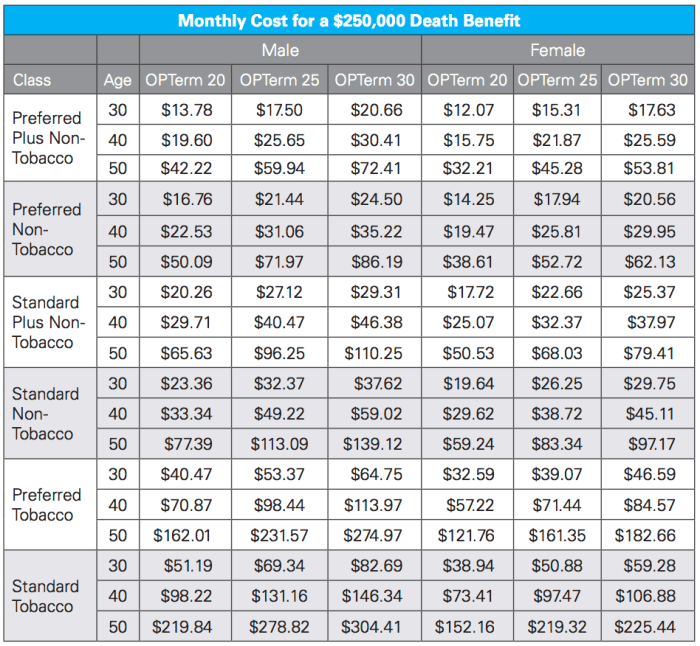

Interpreting Rate Tables

Insurance company rate tables typically list premiums based on age, coverage amount, and sometimes gender and smoking status. The table will have rows representing age ranges and columns representing different coverage amounts. The intersection of a row and column will show the monthly or annual premium for that specific combination. For example, you might find a cell showing a monthly premium of $50 for a 30-year-old seeking $250,000 in coverage. It’s crucial to carefully examine all the details, including any additional fees or riders, before making a decision.

Typical Rate Increases with Age

The rate of increase in premiums isn’t constant across all age ranges. Generally, the increase accelerates as you get older. While the difference between premiums for a 25-year-old and a 30-year-old might be relatively small, the difference between a 45-year-old and a 50-year-old will typically be more substantial. This is due to the increasing probability of death as age increases. The exact rate of increase varies among insurance providers and depends on various factors including the underwriting process and the insurer’s risk assessment models. However, a general upward trend is always observed.

Finding and Comparing Rates

Securing the best 30-year term life insurance rate involves diligent research and comparison shopping. Don’t rely on just one quote; obtaining quotes from multiple providers is crucial to ensuring you find the most competitive price for your needs. This section details the process of obtaining and comparing quotes effectively, including tips for negotiation and assessing insurer financial strength.

Obtaining Quotes from Multiple Insurance Providers

To begin your search, utilize online comparison tools and directly contact several insurance companies. Many websites allow you to input your details and receive multiple quotes simultaneously. However, remember that these online tools often work with a limited number of insurers, so direct contact with additional providers is advisable. When contacting companies directly, be prepared to provide accurate information regarding your age, health, desired coverage amount, and smoking status.

Comparing Quotes Effectively

Once you have collected several quotes, comparing them effectively is essential. Avoid simply focusing on the premium amount alone. Consider the policy’s features, including the death benefit, the length of the term, any riders offered, and the insurer’s reputation and financial stability. A lower premium might be offset by limitations or exclusions within the policy itself. Create a spreadsheet or use a comparison tool to organize the quotes side-by-side, highlighting key features and differences. This will facilitate a more informed decision.

Negotiating Lower Rates

While negotiating life insurance rates isn’t always easy, it’s worth exploring. Good health, a non-smoking status, and a history of responsible financial behavior can be leverage points. Highlight these positive factors when communicating with insurers. You can also inquire about discounts for bundling policies or for paying premiums annually instead of monthly. Remember to be polite and professional throughout the negotiation process.

Assessing Insurer Financial Stability

Before committing to a policy, research the financial stability of the insurance company. A financially sound company is less likely to face difficulties paying out claims in the future. You can check insurer ratings from independent agencies such as A.M. Best, Moody’s, and Standard & Poor’s. These ratings provide insights into an insurer’s financial strength and ability to meet its obligations. Choosing a financially stable insurer offers peace of mind knowing your beneficiaries will receive the death benefit when needed.

Hypothetical Policy Comparison

The following table illustrates how different providers might offer varying features and prices for a 30-year term life insurance policy. Remember that these are hypothetical examples, and actual rates will vary based on individual circumstances.

| Provider | Annual Premium (35-year-old, $500,000 coverage) | Death Benefit | Riders Available | Financial Strength Rating |

|---|---|---|---|---|

| Insurer A | $1,200 | $500,000 | Accidental Death Benefit, Terminal Illness Rider | A+ |

| Insurer B | $1,000 | $500,000 | Accidental Death Benefit | A- |

| Insurer C | $1,350 | $500,000 | Accidental Death Benefit, Waiver of Premium | A+ |

Important Considerations Before Purchasing

Purchasing a 30-year term life insurance policy is a significant financial decision. It’s crucial to thoroughly understand all aspects of the policy before committing to a long-term contract. Failing to do so could lead to unexpected costs or inadequate coverage.

Policy Terms and Conditions

Understanding the policy’s terms and conditions is paramount. This includes the definition of covered events, the payout amount, the length of the coverage period (30 years in this case), and the conditions under which the benefits are payable. A clear comprehension of these details ensures that the policy aligns with your needs and expectations. For example, some policies might have specific exclusions related to pre-existing conditions or high-risk activities. Carefully reading and understanding the fine print is essential to avoid any surprises later.

Policy Exclusions and Limitations

All insurance policies contain exclusions and limitations. These specify circumstances or events that are not covered by the policy. Common exclusions might include death resulting from self-harm or participation in illegal activities. Limitations might include caps on the payout amount for specific causes of death or restrictions on when claims can be filed. Thoroughly reviewing these sections is vital to ensure the policy provides the level of protection you require. For instance, a policy might exclude coverage for death caused by pre-existing conditions if not disclosed accurately during the application process.

Implications of Missed Premium Payments

Missing premium payments can have serious consequences. The most immediate outcome is the lapse of the policy, meaning your coverage terminates. This leaves you without the financial protection the policy was intended to provide. While some policies offer grace periods, allowing a short time to make a late payment without immediate cancellation, missing payments consistently can lead to higher premiums or even the inability to reinstate the policy in the future. The policy terms will clearly Artikel the specific consequences of late or missed payments. In some cases, a policy can be reinstated with evidence of insurability and back payments, but this is not always guaranteed.

Common Policy Riders and Associated Costs

Policy riders are optional additions that enhance the coverage provided by the base policy. They often come with an additional cost. Common riders include accidental death benefits (paying out a larger sum if death results from an accident), critical illness coverage (providing a lump sum payment upon diagnosis of a serious illness), and waiver of premium (waiving future premiums if the policyholder becomes disabled). Before adding riders, carefully weigh the extra cost against the potential benefits. For example, an accidental death benefit rider might double the payout in case of accidental death, but it will increase your monthly premium. It’s essential to assess whether the increased cost justifies the additional protection.

Checklist of Questions for an Insurance Agent

Before committing to a policy, it’s beneficial to have a clear understanding of all its facets. Here’s a checklist of questions to ask your insurance agent:

- What are the specific terms and conditions of the policy?

- What are the policy’s exclusions and limitations?

- What are the consequences of missing premium payments?

- What riders are available, and what are their costs?

- What is the claims process, and how long does it typically take to receive a payout?

- What is the policy’s cash value (if applicable)?

- Are there any discounts or special offers available?

- What are the policy’s renewal terms?

Asking these questions will help you make an informed decision and ensure the policy meets your needs and budget.

Epilogue

Choosing a 30-year term life insurance policy requires careful consideration of your individual circumstances and financial goals. By understanding the factors influencing rates and diligently comparing quotes from different providers, you can secure a policy that provides adequate coverage without unnecessary expense. Remember, proactive planning and informed decision-making are key to safeguarding your family’s financial well-being.

FAQ Explained

What is the difference between a 30-year term and a whole life policy?

A 30-year term policy provides coverage for a specified 30-year period, after which coverage ends. Whole life insurance provides lifelong coverage, but premiums are generally much higher.

Can I change my policy after it’s issued?

Policy changes are possible, but often involve a review of your health and may lead to premium adjustments. Consult your insurer for details.

What happens if I miss a premium payment?

Missing payments can lead to policy lapse, meaning your coverage ends. Grace periods are usually offered, but it’s crucial to contact your insurer immediately if you anticipate difficulty making payments.

How often are premiums paid?

Premiums can be paid monthly, quarterly, semi-annually, or annually. The frequency affects the overall cost, with annual payments generally being slightly cheaper.